Intuitive Surgical Inc (ISRG – Free Report) posted adjusted earnings of $2.54 per share in the fourth quarter of 2017, which beat the Zacks Consensus Estimate of $2.27 and improved 25.1% year over year.

Revenues increased 17.9% year over year to $892.4 million, driven by growth in Instrument & Accessories, Services and Systems segments. Revenues also beat the Zacks Consensus Estimate of $864 million. The stock has a Zacks Rank #3 (Hold).

FY17 at a Glance

Intuitive Surgical reported revenues of $3.12 billion in full-year 2017. The company has three major revenue segments — Instruments and Accessories (52.3% of total revenues), Systems (29.1% of total revenues) and Services (18.6% of total revenues).

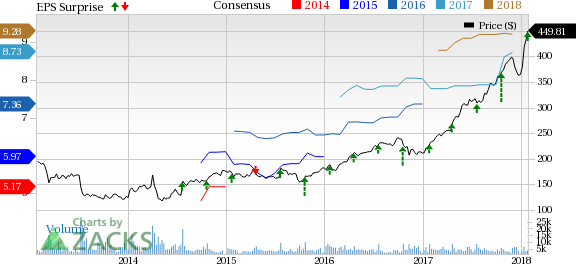

Intuitive Surgical, Inc. Price, Consensus and EPS Surprise

Intuitive Surgical, Inc. Price, Consensus and EPS Surprise | Intuitive Surgical, Inc. Quote

Business Highlights

Solid Procedure Trends

Intuitive Surgical posted solid numbers in the quarter, courtesy of rising customer adoption of procedures and growth in system placements. The company outperformed in the Mature and Growth procedures, especially in general and thoracic surgery.

Precisely, fourth-quarter procedures increased approximately 17% on a year-over-year basis. Procedure performance in Asia reflected persistent strength backed by solid growth in China, Japan and Korea. Added to this, growth in prostatectomy procedure volumes lent the company a competitive edge in the broader prostate surgery market in the fourth quarter.

Favorable Study Results

In November 2017, a team of investigators from the University of Southern California, the University of Michigan Ann Arbor, Penn State Health and Intuitive Surgical published a large-scale study titled ‘Robotic-Assisted, Video-Assisted Thoracic and Open Lobectomy: Propensity Matched Analysis of Recent Premiere Data in the Annals of Thoracic Surgery’.The results from this study demonstrated the increase in the number of robotic-assisted lobectomies. Lobectomy can be defined as surgical excision of a lobe or an organ.

Leave A Comment