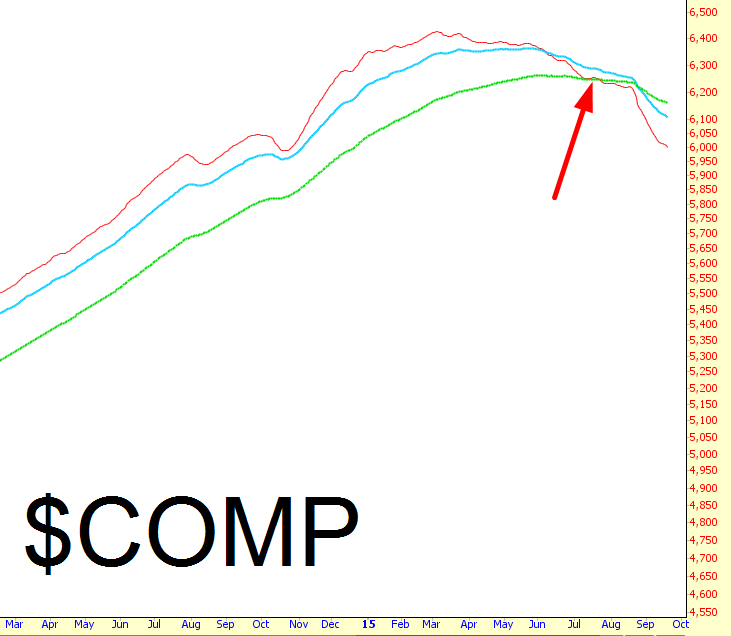

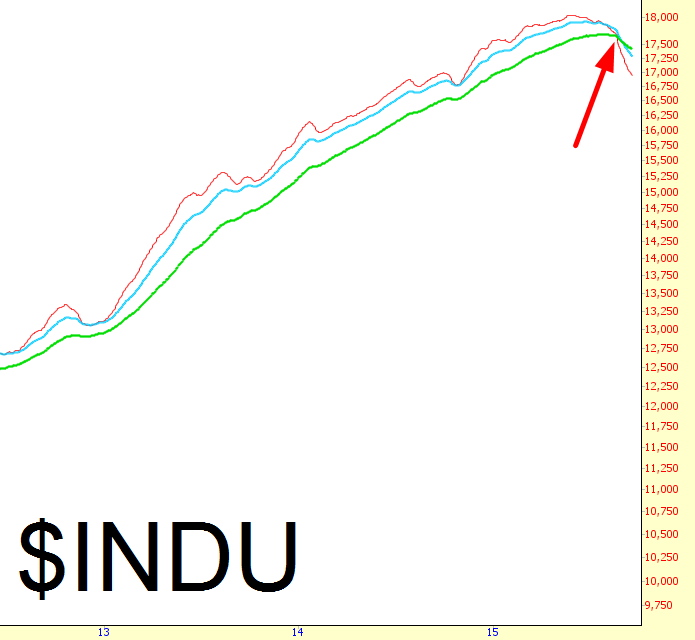

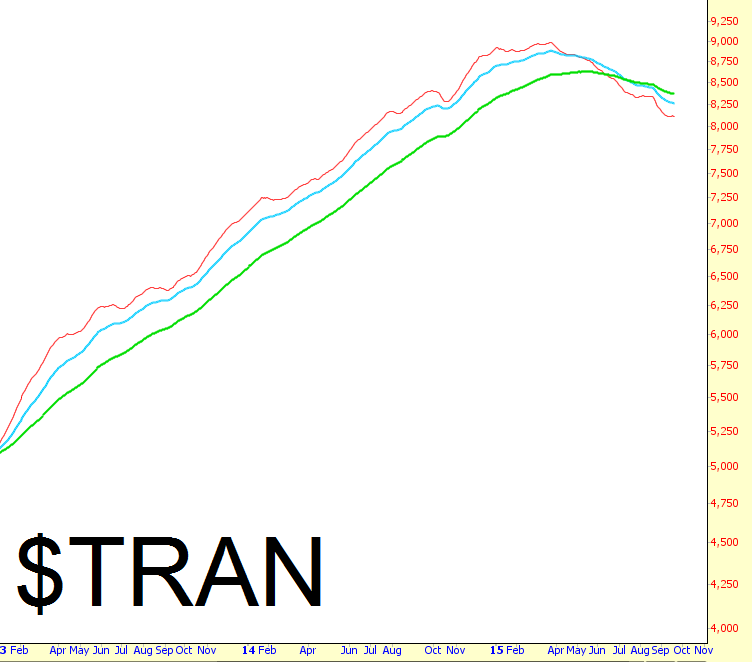

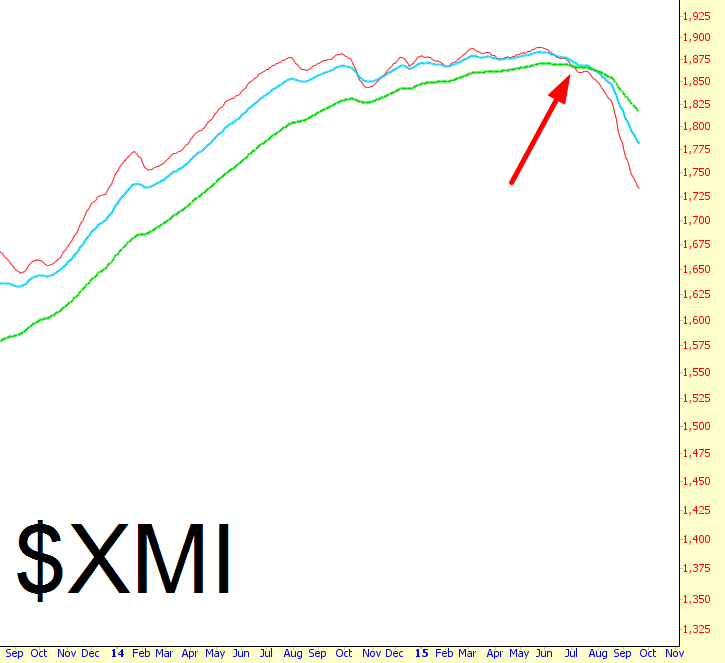

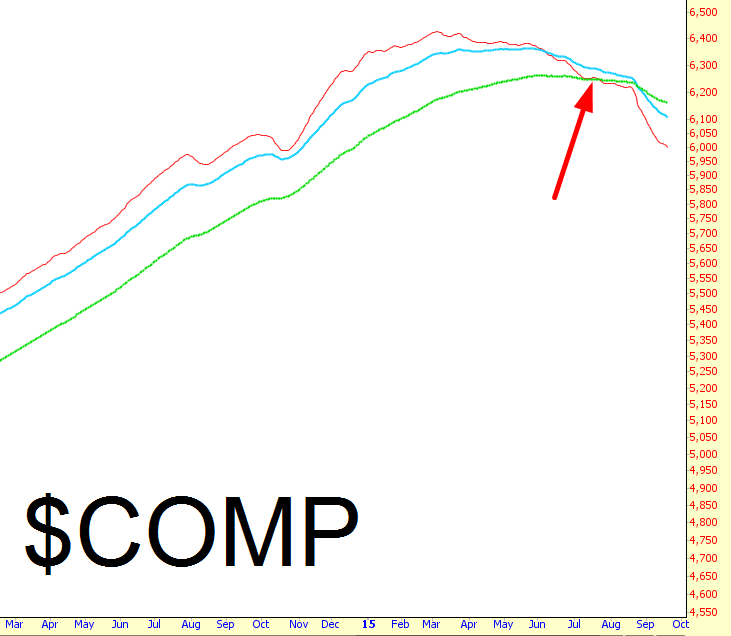

After years of waiting, I truly believe the wind is at the back of the bears now. Although I do not tend to use indicators, I glanced at some critical equity indexes to see what they were doing with respect to their 50, 100, and 200 day exponential moving averages. The crossovers seem, for the most part, to be clear and complete:

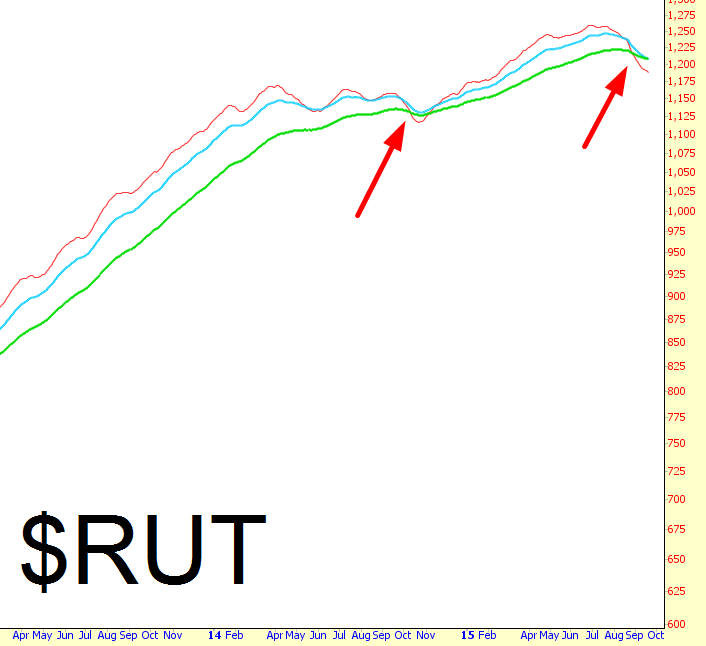

As always, I avoid getting overly sanguine, since surprises can sometimes happen. Take a look at the Russell 2000 last year, at the Bullard low in mid-October. We had a modest crossover then (middle arrow) just like we do now (right arrow), and you know what happened next. All the same, the preponderance of these crossovers, and their great “depth” compared to this one exception shown below, makes me confident about the months ahead.

Leave A Comment