It’s a battle as old as markets.

Which is the better investment: gold or stocks? Gold Bugs and Equity Bulls are equally fervent about their investment of choice, often with complete disdain and contempt for the other side.

The story (since the gold standard was completely abandoned in August 1971) goes something like this…

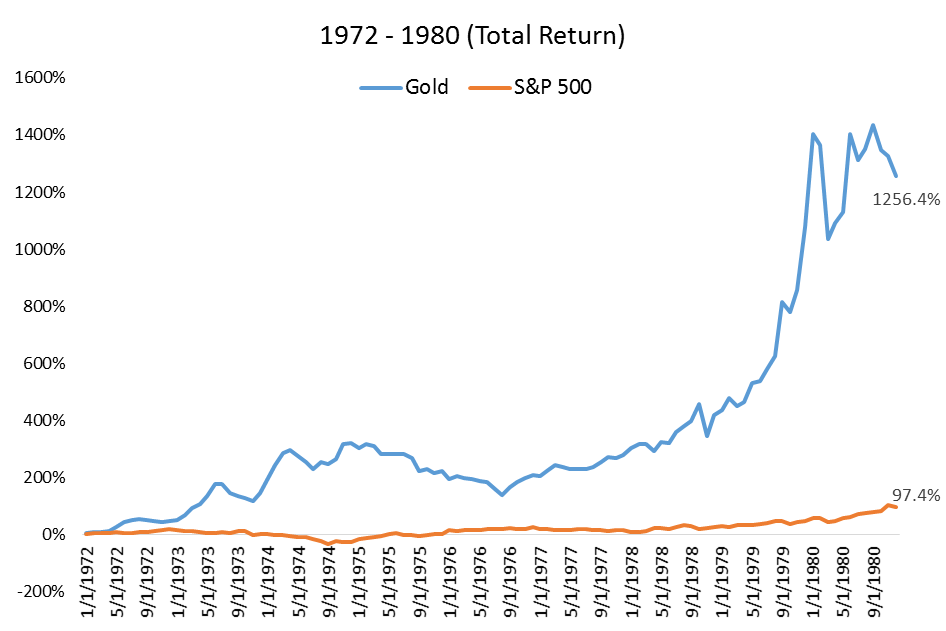

1972-1980

Gold Return: +1256%

S&P 500 Return: +97%

Narrative: Gold is the best investment in the world, and will continue to be so forever. There is hyperinflation in the U.S. and a secular stagnation in real growth. The only way to protect yourself is with Gold. And by the way: no one should own stocks.

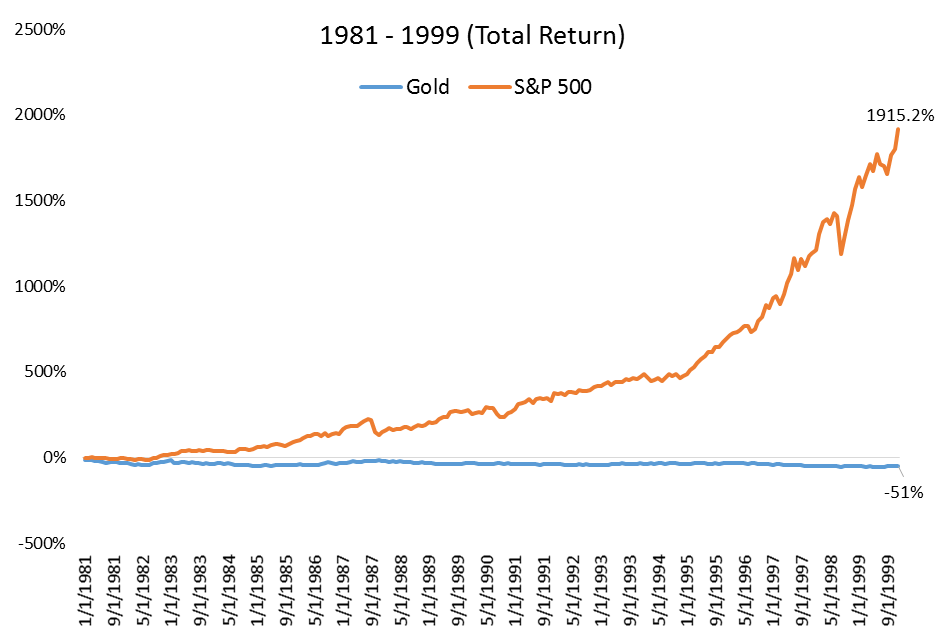

1981-1999

Gold Return: -51%

S&P 500 Return: +1915%

Narrative: Stocks are the greatest investment the world has ever known, and will continue to be so. The internet age has forever changed investing returns and valuations; there is no upward limit to the growth in stocks in the coming years. The only way to participate in this new golden age is to be long stocks. And by the way: no own should ever own Gold.

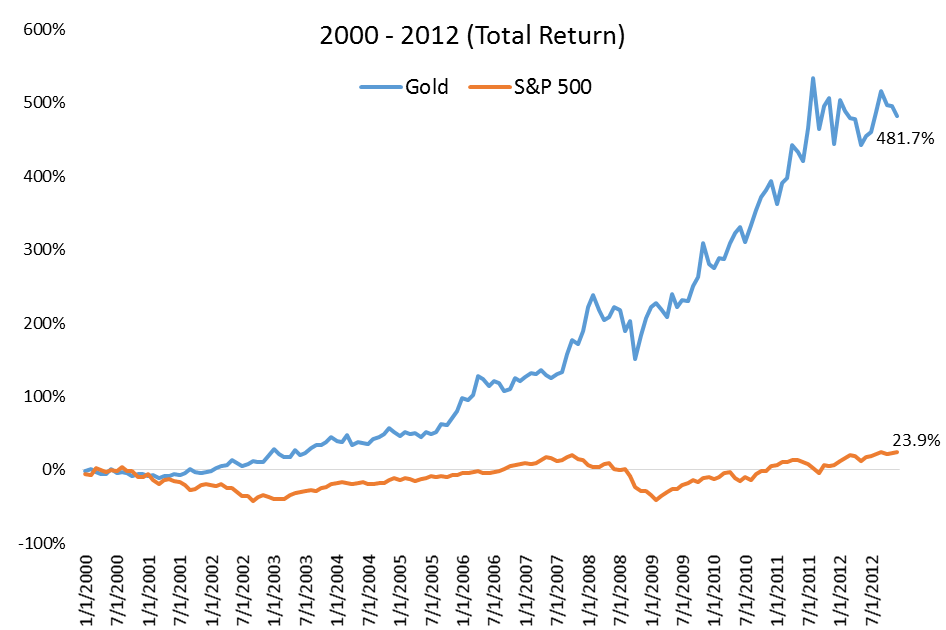

2000-2012

Gold Return: +482%

S&P 500 Return: +24%

Narrative: Stock investors have suffered through two 50% bear markets while Gold has more than quintupled. These are deflationary, depression-like conditions and only Gold can protect investors from what’s to come. This is especially true given the “money printing” by central banks. And by the way: stocks are terrible investments.

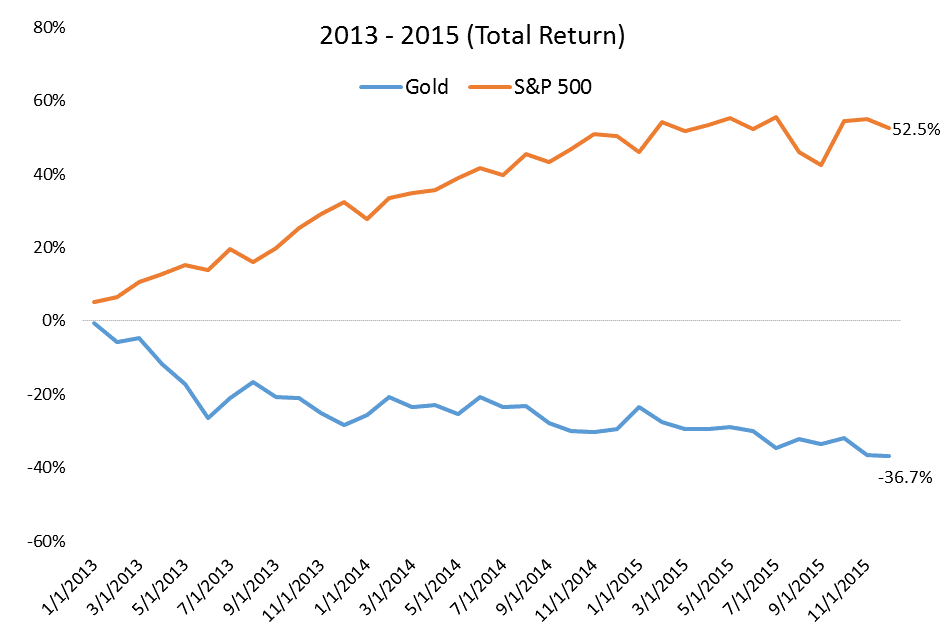

2013-2015

Gold Return: -37%

S&P 500 Return: +53%

Narrative: We’re in a Goldilocks period of low inflation and unlimited central bank easing. This is unbelievably bullish for stocks and very bad for Gold. This environment will continue forever. And by the way: Gold is a pet rock.

And so that’s how we entered 2016, with perma Equity Bulls lobbing ad hominem attacks at the seemingly foolish Gold Bugs.

What has happened thus far in 2016? You guessed it. Gold is up 7.7% while the S&P 500 is down -6.6%.

Leave A Comment