Those who have been following along might recall that three weeks ago, a swoon in crude prices catalyzed one of the largest outflows from HY funds on record.

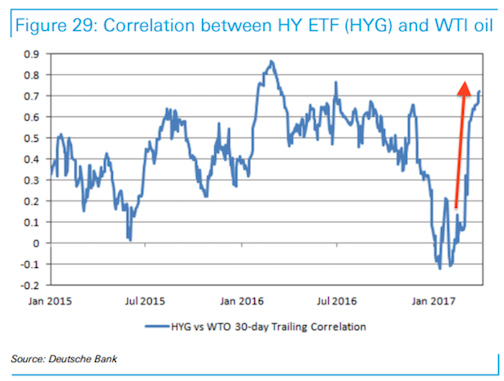

As it turns out, HY becomes highly correlated with oil prices when the latter hits a rough patch. Who knew? In fact, when oil collapsed, the correlation between everyone’s favorite junk bond ETF and oil suddenly spiked to levels last seen during the deflationary doldrums of early 2016:

(Deutsche Bank)

Again, “who knew?”

Well, HY has calmed down a bit since then and amusingly, flows data shows that in the week through Wednesday, investors fled equity funds for the “safety” and “security” of junk.

“Equity fund flows kicked off the new quarter with sizable outflows as mutual funds posted outflows of $7.4bn across both domestic (-$4.7bn) and international funds (-$2.7bn),” Goldman wrote on Friday, adding that “equity ETFs posted outflows of $4.5bn, the weakest figure since mid-September 2016.”

As tipped above, while some folks were busy exiting equity funds, some other folks (or very likely the very same folks) were busy buying HY.

Investors moved “out of stocks and into high yield,” BofAML observed on Thursday. The bank’s credit team continued as follows:

High yield US funds and ETFs received their first large inflow for the year this past week ending on April 5. Inflow to high yield jumped to $2.45bn – the highest since December of last year – and up from a $0.93bn inflow the week before.

Just call it a “flight to (relative) safety.”

Leave A Comment