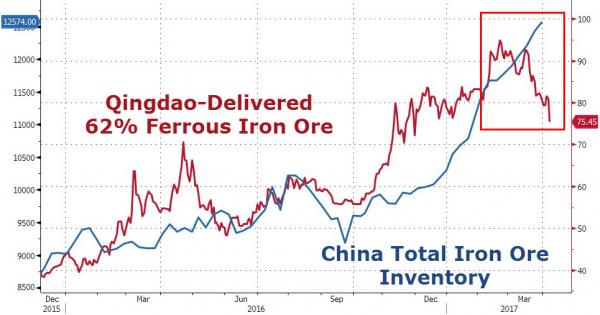

Just a week ago we warned of China’s record glut of Iron Ore (enough to build 13,000 Eiffel Towers), and following warnings from Barclays and RBA of a likely pullback, futures in Dalian sank to lowest since November as steel sags.

Bloomberg reports that iron ore is getting beaten back down in a told-you-so rout after a procession of analysts, Australia’s central bank and miners themselves delivered warnings that gains were unsustainable, with the latest blow landed by the world’s top shipper saying prices are set to revisit the $50s.

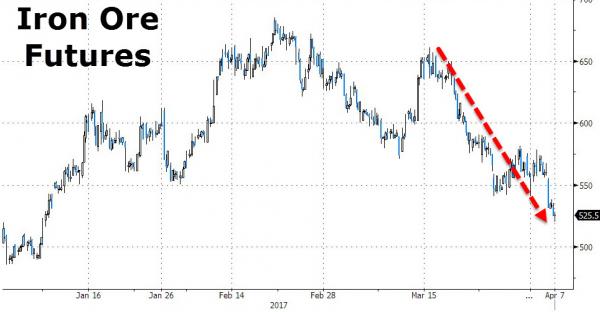

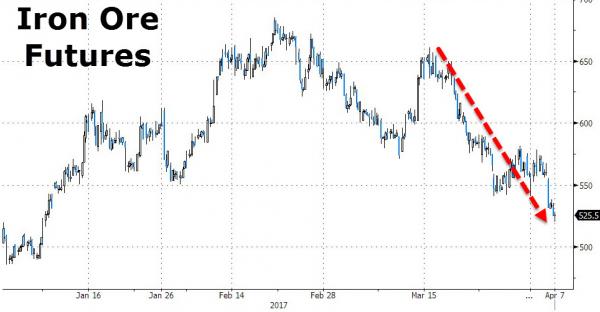

Ore with 62 percent content in Qingdao fell 6.8 percent to $75.45 a dry ton, entering a bear market after declining more than 20 percent from a Feb. 21 peak, according to Metal Bulletin Ltd. The price has now erased all of this year’s gains, declining 3.1 percent. Earlier in Asia, futures in Dalian plunged 6.2 percent to the lowest close in five months as steel sank.

Iron ore is in retreat after hitting the highest level since 2014 in February amid concern that rising supplies from mines in Brazil, Australia and possibly China will again exceed demand, with warnings from Barclays and BHP Billiton flagging losses. There’s also concern that additional curbs in China may hurt consumption.

“There’s an expectation that tighter credit conditions in China will lead to some downturn in property construction in the second half,” said Ric Spooner, chief market analyst at CMC Markets in Sydney. “At the same time, both seaborne and domestic Chinese iron ore supply looks likely to increase. With Chinese port inventories remaining high, traders are seeing downside risk.”

This is certainly not helping the concept of a global reflation trade as yet again, massive credit-fueled capital mis-allocation simply papers over short-term cracks leaving a bigger more damaging hangover in its wake… unless just a little more credit fueled zombification will help.

Leave A Comment