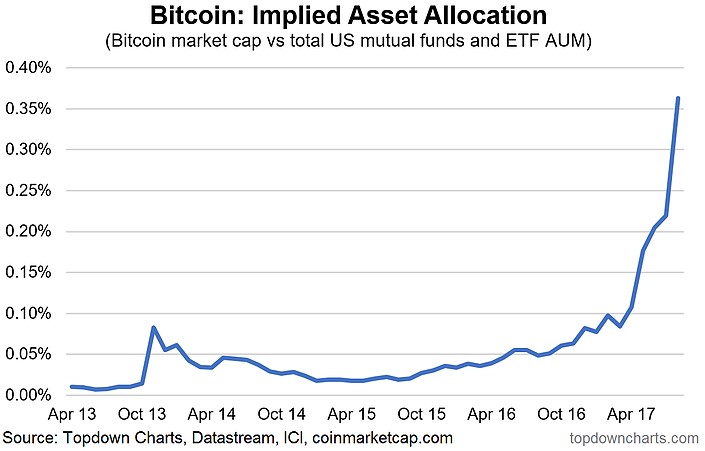

Bitcoin Under-Owned?

As we discussed in the last article, institutional investors said Bitcoin was the most overvalued security in the world. Since my last post, the price of Bitcoin has fallen below $4,000. Some of the speculation has left the market. The chart below gives you an additional way to look at Bitcoin. It compares Bitcoin’s market cap to the total U.S. mutual funds and ETF assets under management. This is an end-around to get to the asset allocation. Since the only ETF which lets you buy Bitcoin is the Bitcoin Investment Trust which sells Bitcoin at a premium, I doubt that number is accurate. Bitcoin is taking in money from speculators. Those who do venture deals and invest in startups are the people investing in Bitcoin. Cryptocurrencies take in money from young investors just like how the 1990s tech stocks had young investors.

While this chart isn’t perfectly accurate, it does make the argument that many hedge fund managers wouldn’t take the plunge into Bitcoin because it’s too volatile look foolish. Obviously, many people with capital have invested in Bitcoin. That’s how it got to $5,000. Looking at Bitcoin as a percentage of the assets under management is like how gold investors determine if the yellow metal is under owned or over owned. Bitcoin has an advantage over gold in that it’s being used to transact. It has a function which encourages more people to buy it. The hope is that with the expanding price garnering attention, more people will learn about it and use it to buy goods and services online.

New iPhone X Is Released

The new iPhone devices were unveiled on Tuesday, dominating the headlines. As expected, Apple released 3 new models, the iPhone 8/8 Plus and the iPhone X. Some investors were disappointed with the delayed launch of the iPhone X, which can be pre-ordered on October 27th and bought on November 3rd, but that isn’t an issue in my opinion. It’s still going to be available for the Christmas sales rush. As we discussed before the release of the devices, the key push for Apple is going to be differentiating the iPhone X from the iPhone 8/8 Plus to upsell as many people as possible. Apple did this by bringing the infinity display only to the iPhone X. The iPhone X also has face recognition instead of a finger print scanner. This is going to get Apple fans to pay the $999 that the iPhone X costs instead of the $699/$799 that the iPhone 8/8 Plus cost. The risk Apple is taking is that the middle range Android phones, now have superior screens to the iPhone 8/8 Plus. The Samsung Galaxy S8 has an infinity display and costs $100 less. That might be a problem for Apple. It will hurt market share, but help profitability. Samsung’s Galaxy S8 is a great device, but it’s too good in the sense that it prevents people from buying the Note 8.

Leave A Comment