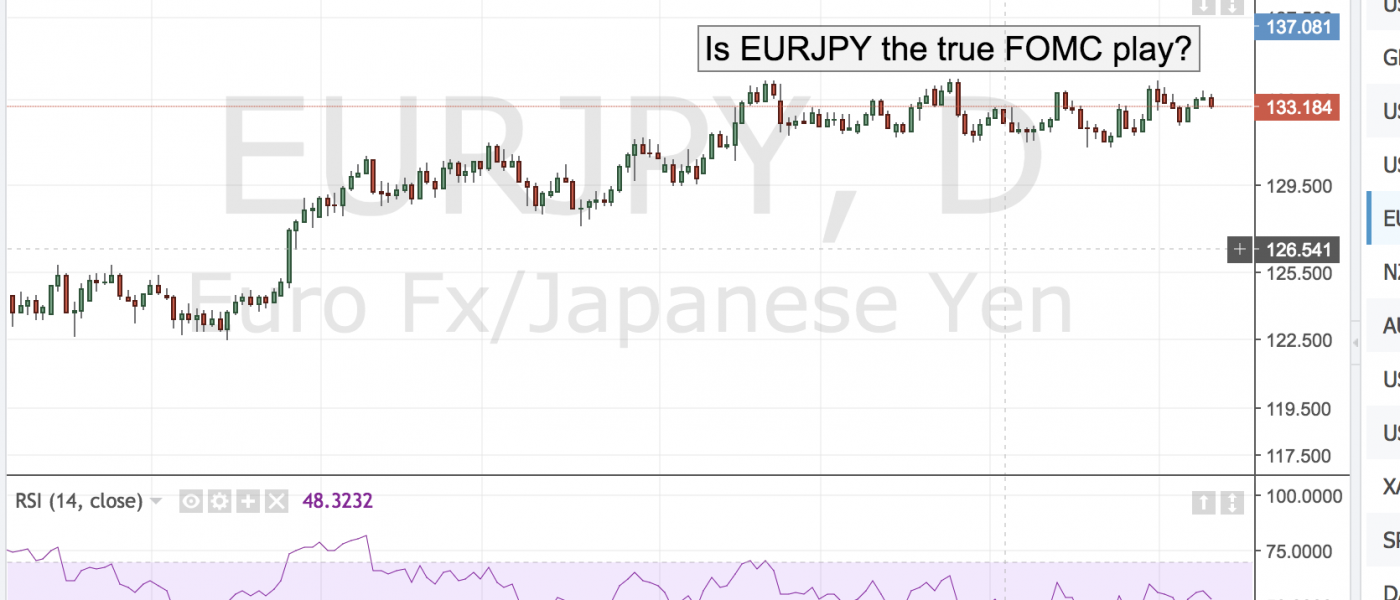

For the past few weeks, EURJPY has been contained to a 132.00-133.00 zone as the push/pull tug of war between bulls and bears provided no clear winner. The market essentially remains in a “show me” mode as traders await the FOMC rate decision and more importantly its guidance about the growth and inflation in 2018.

While the chance of a rate hike tomorrow is 100%, the much more important question is whether the Fed has now moved unambiguously into a tightening mode as it tries to normalize policy. If the statement tomorrow looks past the weak inflation numbers and instead upgrades the growth forecast the dollar is likely to rally hard against the yen, but may not necessarily gain much ground against the euro as markets will assume that Fed’s upbeat outlook will spill over into global demand and will, therefore, force the ECB to become more hawkish as well. That’s why EURJPY may be the best yen cross for a bullish FOMC day especially if it breaks above the 135.00 resistance level clearing the way for a strong rally into the year-end.

Leave A Comment