Some readers responded to last Wednesday’s post on gold’s trading pattern (Gold: Resistance Is … Finite) with shock that I didn’t know gold is a manipulated market where technicals don’t matter.This gives us a good jumping-off point for a look at several forms of gold manipulation that have been practiced over the years:

Wall Street traders use false gold orders to “spoof” their counterparts at other banks into revealing their order books, thus profiting from the stolen information. This is illegal — some traders recently went to jail for such dicking around. But it’s irrelevant to the long-term price of gold, so of no interest to stackers and/or mining stock investors.

Commercial fabricators — companies that buy raw gold and turn it into useful things — frequently trick hedge funds and other speculators into going excessively long or short in the futures markets. They — the commercials — then take the opposite side of the trade and manipulate the market to profit from the hedge funds’ losses. Those articles you see on the “COT Report” are analyzing this game. It’s interesting and possibly useful for in-and-out traders, but meaningless for the long-term price of gold, so again not our concern.

Western governments loan their monetary gold to “bullion banks” which then sell it on the open market to depress the price. The rationale for this manipulation is that gold is a direct competitor for fiat currencies. When gold goes up, that’s the same as saying the dollar, euro, and yen are going down, and the egomaniacal morons running Western central banks can’t tolerate that kind of exposure. So they secretly intervene to depress the price. And the effects are long-lasting, so historically it’s been a very real concern for gold bugs. When people (like those in the comments section) talk about manipulation, this is probably what they mean.

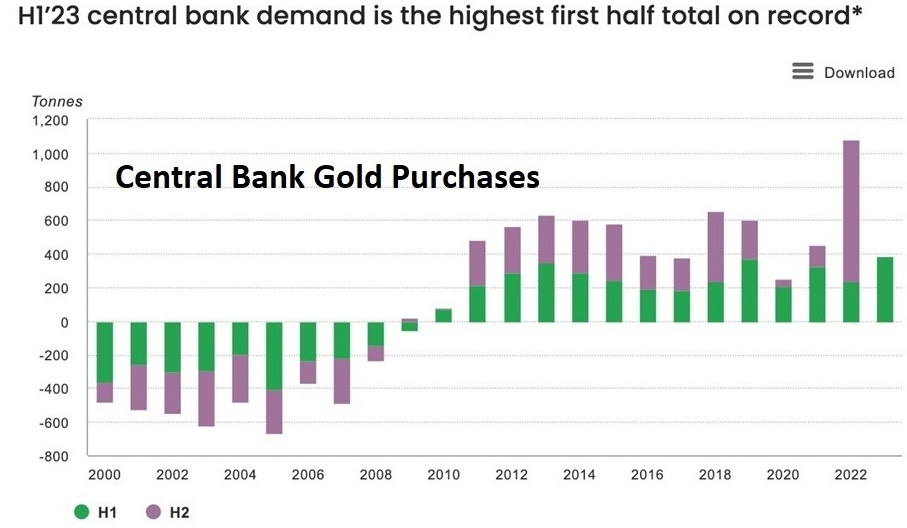

But those days are over nowEurope, Canada, and the US dumping their gold definitely restrained the metal’s price, which would be $5000 or more in a truly free market. But this suppression was achieved by central banks that had a measure of control over the market, and that control ended in 2008 when other central banks started buying gold.The following chart shows that central banks were net sellers of gold prior to the Great Recession. But when the Fed, ECB, BoJ, and BoE met the housing crash with massive QE while using the dollar as a weapon against any country that threatened the Empire’s interests, other central banks started buying gold for protection. And lately, that buying has become a frenzy. The most recent data (not shown here) has 2023 coming in on par with 2022. 1,000 tons of gold in a single year is massive accumulation.  Now let’s consider gold’s trading action in this century. Does the following chart look like an artificially suppressed asset? Not really. Gold had a hell of a run when QE and negative interest rates first reared their ugly heads and then treaded water for a while to build a new base. Very normal free market trading behavior.

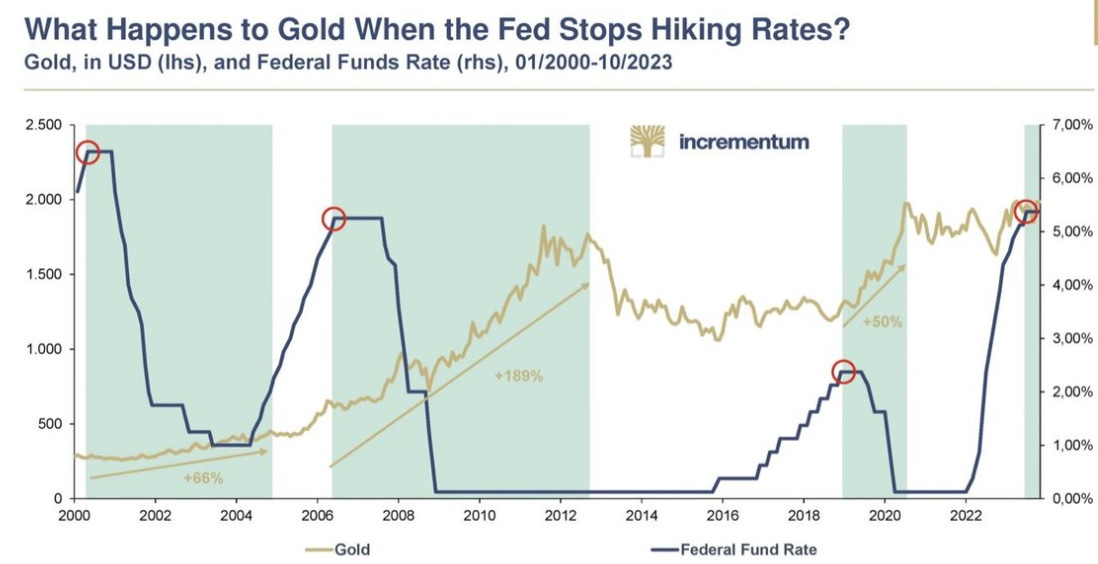

Now let’s consider gold’s trading action in this century. Does the following chart look like an artificially suppressed asset? Not really. Gold had a hell of a run when QE and negative interest rates first reared their ugly heads and then treaded water for a while to build a new base. Very normal free market trading behavior.  Good luck manipulating this marketToday, the West can go ahead and sell as much gold as it wants. China, Russia, and India will happily take it, and then some. The impact of those sales on the price of gold is minimal in the short run (because it’s met with enthusiastic buying) and positive in the long run because the more gold the BRICS countries accumulate, the higher its likely future price becomes.Actually, the following chart is more important to gold’s near-term price action than any kind of manipulation. When the Fed stops tightening, gold goes up, easy peasy. And 2024 will almost certainly see the Fed stop tightening and stat easing, possibly in a panic.

Good luck manipulating this marketToday, the West can go ahead and sell as much gold as it wants. China, Russia, and India will happily take it, and then some. The impact of those sales on the price of gold is minimal in the short run (because it’s met with enthusiastic buying) and positive in the long run because the more gold the BRICS countries accumulate, the higher its likely future price becomes.Actually, the following chart is more important to gold’s near-term price action than any kind of manipulation. When the Fed stops tightening, gold goes up, easy peasy. And 2024 will almost certainly see the Fed stop tightening and stat easing, possibly in a panic.  More By This Author:Gratitude Check: Gold Price Resistance Proves Sound Money Works Precious Metal Predators: Short Sellers Look to TSX:V MinersGold: Resistance Is…Finite

More By This Author:Gratitude Check: Gold Price Resistance Proves Sound Money Works Precious Metal Predators: Short Sellers Look to TSX:V MinersGold: Resistance Is…Finite

Leave A Comment