Hasten slowly and ye shall soon arrive. – Milarepa

In August, we came out and openly stated that it was not the time to buy Gold. At that time, many analysts were calling for a bottom and much higher prices. We stated that there was a high probability that Gold would move lower before bottoming out. Fast forward and that outlook has come to pass.

So let’s see what picture fundamentals paint.

Demand for Gold is soaring, according to the World Gold council’s latest report.

The latest report shows that overall worldwide demand for Gold soared by a whopping 33%.

Americans are jumping into the foray also; U.S retail demand for Gold soared to 32.7 metric tons, 200% more than the same period last year.

The report also states that Gold demand in China surged to by 70% to 52 metric tons.

Europeans also appear to be loading up on Gold. Demand increased by 35% to 61 metric tons.

So what gives; why are gold prices not soaring?

Based on fundamentals, the dollar should have crashed long ago, as the U.S. Fed has created more money in the last ten years than it has created in the last 100. Fundamentals would have had you jumping into energy and oil stocks just when they tanked. Up unit the very moment oil crashed, all the experts were screaming about a shortage of oil and surging demand in Asia. Overall demand in Asia continues to rise, but the same individuals are now singing a different song. Instead of less oil, they are now singing the oversupply song; oh how fast they jump ship.

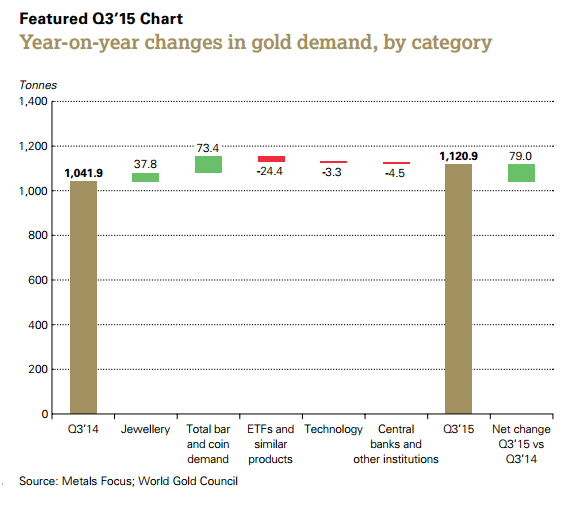

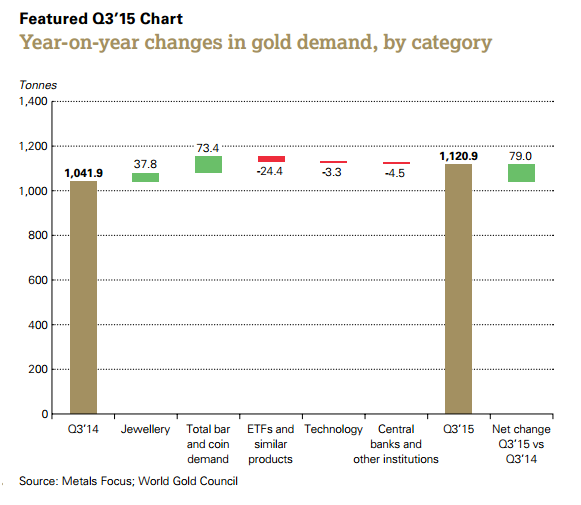

The following charts illustrate that Gold demand is increasing, so what gives?

The chart from the world Gold Council clearly indicates that demand for this precious metal is rising.

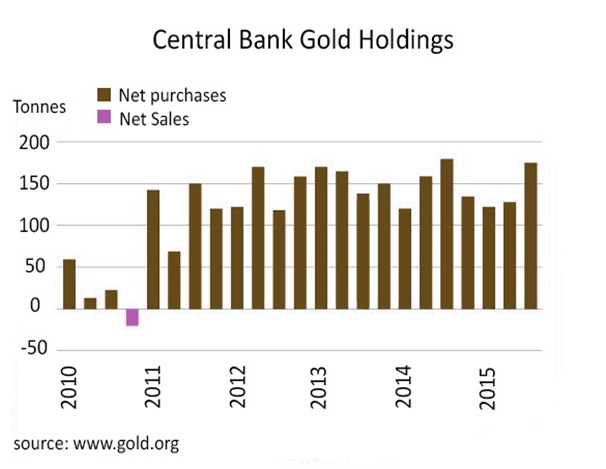

Central bankers are busy loading up on the metal. The main buyers are Russia and China. Perhaps they are privy to information that the general public is not? Whatever, the reason, central bankers appear to be aggressively stocking up on Gold.

Leave A Comment