HCP Inc. (HCP) is the only real estate investment trust (REIT) in the S&P 500 Dividend Aristocrats Index.

Generally speaking, dividend aristocrats are some of the most reliable dividend-paying stocks in the market. After all, it takes meaningful competitive advantages and a committed management team for a business to pay higher dividends for at least 25 consecutive years.

We own several aristocrats in our Top 20 Dividend Stocks portfolio, but HCP possesses several characteristics that require a closer look. With the stock down about 20% over the last year, now is a good time to review if HCP is a high yield dividend aristocrat worth buying or a potential value trap.

Business Overview

HCP is a real estate investment trust (REIT) with over 1,200 properties in the healthcare sector. The company went public in 1985 with 24 skilled nursing facilities and primarily grew by investing billions of dollars in acquisitions to expand its portfolio.

HCP makes money by renting out its properties to healthcare companies such as senior living centers and doctors’ offices. Roughly half of HCP’s investments are under triple net lease agreements, which are generally thought to have lower risk profiles because they require the tenant to pay property taxes, insurance, and maintenance expenses.

By segment, HCP generated 42% of its 2015 revenue from Senior Housing, 24% from Post-Acute/Skilled Nursing, 13% from Life Science, 17% from Medical Office, and 3% from Hospital. The company’s mix of operating income was similar, but it’s worth mentioning that two of HCP’s customers accounted for over 30% of its revenue last year (HCR ManorCare 23%, Brookdale 10%).

Business Analysis

The U.S. healthcare real estate market is extremely fragmented. In an investor presentation, HCP estimated that the market is about $1 trillion in size but public REITs own less than 20% of it.

As the healthcare industry continues to focus on reducing costs, consolidation is likely and should benefit the bigger players. Acquisitions have fueled much of HCP’s historical growth, and we expect them to play a key role in the company’s future strategy as well.

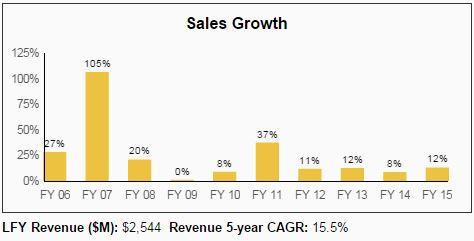

The healthcare market also has attractive demographics. Spending generally continues unabated regardless of economic conditions (sales were flat in 2009), and many of HCP’s properties will benefit as the average age of the U.S. population skews higher over the coming decades to reflect improving standards of living.

Source: Simply Safe Dividends

HCP has also built long-term relationships with many of its tenants, which helps it maintain strong occupancy and renewal rates at its properties. As long as its tenants remain financially healthy, they provide a stable source of revenue for HCP over the duration of their lease.

Despite its strengths, HCP is a business that will never earn high returns on its invested capital due to the capital-intensive nature of real estate, the large number of competitors, and the industry’s relatively low barriers to entry. As seen below, HCP has generated a low- to mid-single digit return on invested capital over the last five years, which is a little below the market’s average return on capital.

Leave A Comment