The Federal Reserve is conducting a grand experiment in monetary policy that’s set to continue in tomorrow’s policy statement, which is expected to roll out another hike in interest rates. The experiment is tightening policy when inflation and employment growth are still low and perhaps heading lower.

In previous tightening cycles, pricing pressure and the year-over-year growth trend in private-sector payrolls was higher if not rising. When the Fed raised interest rates during 2004-2006, for example, private payrolls accelerated from roughly an annual rate of 1.5% to 2.4% and the Fed’s preferred measure of inflation (core Personal Consumption Expenditures) increased from 2.0% to 2.5%.

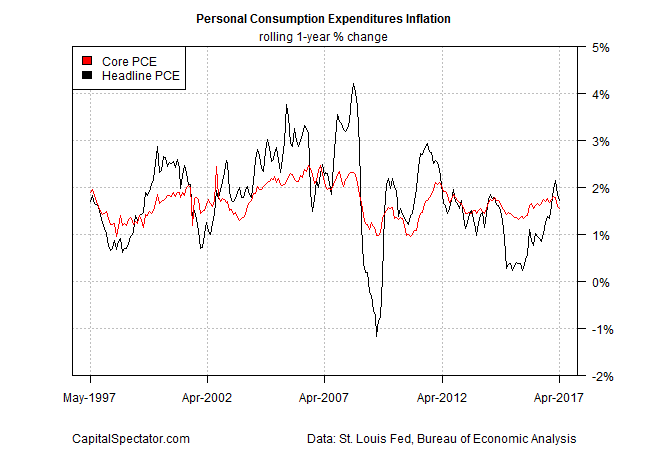

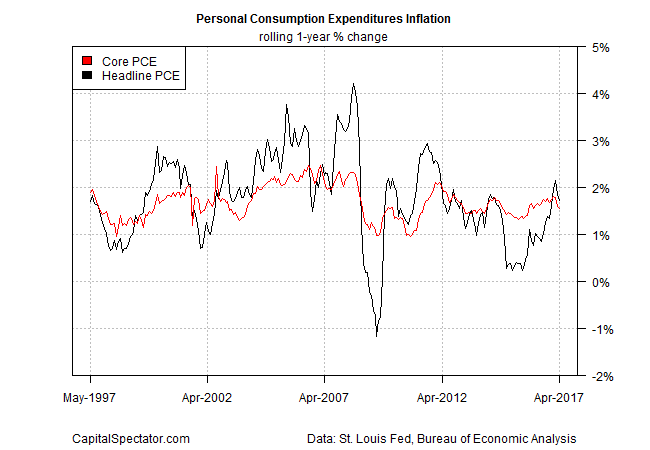

By contrast, core PCE inflation is currently below the Fed’s 2.0% target and ticking lower, dipping to 1.5% for the year through April – the lowest in more than a year.

Private employment growth edged higher in last month’s update, rising to 1.8% vs. the year-earlier level. But it’s unclear if the deceleration trend that’s been unfolding over the last two years has run its course. The peak for this cycle: a 2.6% annual increase through February 2015.

The ideal scenario that the Fed seems to projecting: the economy continues to expand at a moderate pace, perhaps picking up a bit of speed, while inflation stabilizes just below or near the 2% target. In that case, the tailwind gives the central bank sufficiently strong macro conditions to continue lifting interest rates, albeit gradually. This outlook is strengthened by recognizing that recession risk remains low these days and economists are expecting that second-quarter GDP growth will rebound. CNBC’s June 9 survey of forecasters shows growth picking up to 2.9% in Q2 from Q1’s weak 1.1% rise.

The question is whether forward momentum is strong enough to overcome tighter policy? Probably, at least for now. Fed funds futures are pricing in a 96% probability that tomorrow’s FOMC statement will unveil a rate hike, based on CME data this morning. When the dust clears, the Fed’s target rate is projected to rise to 25 basis points to a 1.0%-to-1.25% target range.

Leave A Comment