Rackspace Hosting, Inc. (RAX) Information Technology – Internet Software & Services | Reports May 9, After Market Closes

Key Takeaways

Despite how fast cloud computing is growing, not all players in the industry are winners. Rackspace falls within that category, with shares declining 60% over the last 12 months due to weaker growth guidance. Unfortunately this quarter is expected to be no different, with Rackspace poised to post its first quarter of single digit revenue growth in 2 years.

The Estimize consensus is calling for profits of 23 cents per share on $519.80 million in revenue, 1 cent higher than Wall Street on the bottom line and right in line on the top. Since its last report, EPS estimates have dropped 17%, but still reflecting an 18% increase from a year earlier. Revenue on the other hand is projected to increase 8%, its lowest growth rate in 2 years.

The biggest problem for Rackspace and its peers is a significant revenue slowdown in the cloud computing space. Rackspace plans to spend much of the year ramping up its service only offerings and expanding its strategic partnerships. Last quarter the company launched its service only support for Amazon Web Services, Microsoft’s Azure services, and Office 365. These moves open up a huge opportunity for the company to stay relevant in a saturating market.

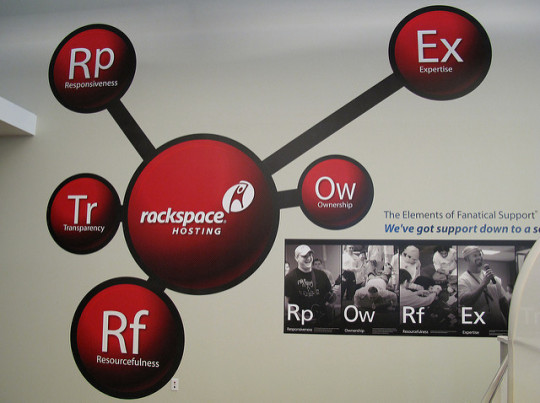

Furthermore, Rackspace is gaining traction in its recently launched Fanatical Support. Since its debut in October, Rackspace has already launched 100 customers. The company has also teamed up with Google to co-design an IBM powered machine to develop new data centers. With all the efforts put forward to promote growth, investors will be looking to see what guidance Rackspace gives for Q2 on Monday.

Leave A Comment