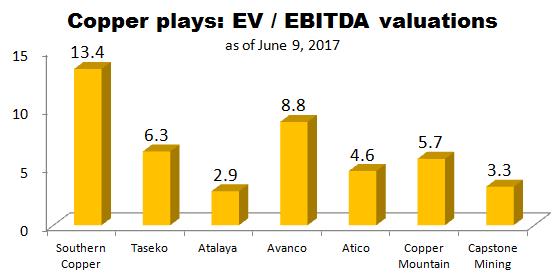

The copper sector looks like the precious metals segment at the end of 2015. Look at the current market valuations of a few copper plays:

source: Simple Digressions

Now most of the copper miners are trading at very low EV / EBITDA ratios. It looks as if the entire copper market was worth nothing or close to nothing.

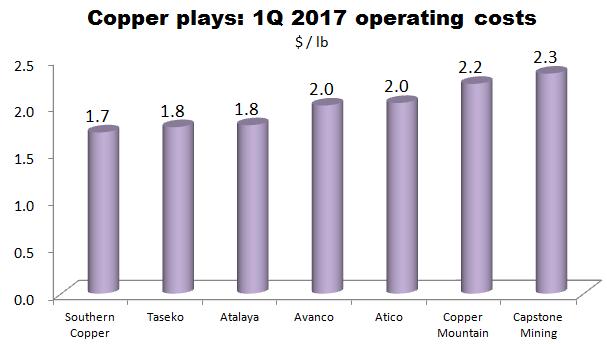

Interestingly, most recently the copper mining companies made similar progress as the precious mining companies did and cut their costs of production significantly. Look at a number of copper plays and their operating costs:

source: Simple Digressions

Note: operating cost is defined as: direct cost of production + royalties + depreciation + administrative expenses + share-based payments + other operating costs

As the chart shows, Southern Copper (SCCO), Taseko Mines (TGB) and Atalaya Mining (TO:AYM) are very-low-cost producers (with operating costs below $2.0 per pound of copper).

The other miners also produce their copper at quite low prices so…what is the problem?

As usually – the problem lies in copper prices. However, the copper price action does not look bad:

source: stockcharts.com

Although I am not a fan of Technical Analysis, sometimes it is good to lookat the big picture. And the big picture delivers an important message: since late October 2016 copper has been in a strong bull market. Now, after the last correction, copper prices try to break out to the upside.

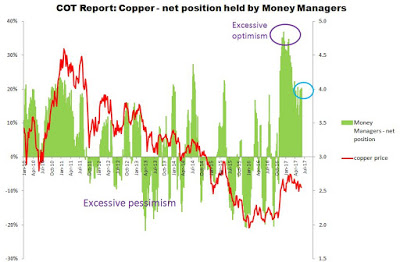

Additionally, the data delivered by the Commitments of Traders report supports a bullish thesis:

source: Simple Digressions and the COT data

The blue circle on the chart above shows the current net position held by Money Managers (mainly hedge funds) in copper futures. Notice that the blue circle is well below the red circle, which indicates the excessive optimism among traders. It means that the copper market is now generally neutral (or far away from overbought conditions).

Now, combining the last two charts it looks like the chances for another leg up in copper bull cycle are higher than the chances for the opposite move…

Leave A Comment