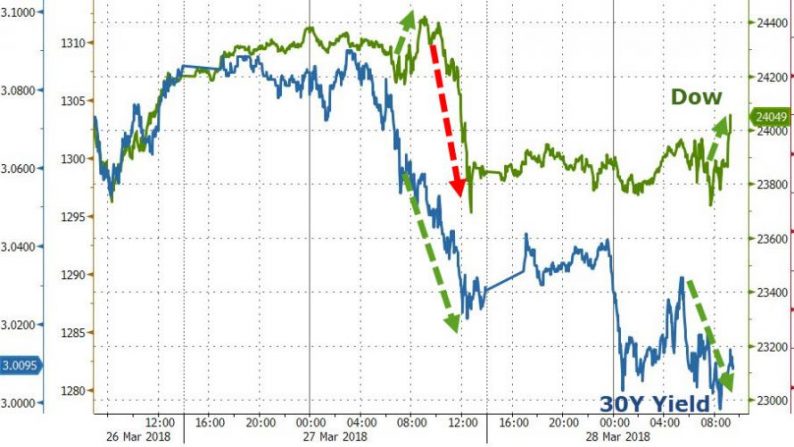

Despite the stock market’s Amazon-bounce gains, US Treasury yields are lower and the yield curve flatter once again – tumbling to its flattest since Oct 2007.

Deja vu all over again…

10Y Yields are holding below 2.80%…

And the yield curve has crashed to fresh flats not seen since Oct 2007…

The entire curve is rolling over…

As a reminder, Bloomberg notes that according to the minutes of the Federal Open Market Committee’s Jan. 30-31 meeting, the most recent for which minutes are available, showed that some policy makers thought it important “to monitor the effects of policy firming on the slope of the yield curve,” noting the strong association between curve inversions and recessions.

Which confirms what The San Francisco Fed warned… about the flattening of the yield curve…

“[it] is a strikingly accurate predictor of future economic activity.

Every U.S. recession in the past 60 years was preceded by a negative term spread, that is, an inverted yield curve.

Furthermore, a negative term spread was always followed by an economic slowdown and, except for one time, by a recession.”

Furthermore, as the two Fed authors explain below, the recent decline in the Treasury curve is sending recession probabilities notably higher.

Leave A Comment