The topic of the unemployment rate has come up a lot recently with regards to debates around full employment, wage growth, inflation, the stage of the business cycle, and of course monetary policy. These are all critical inputs into the macro backdrop which is of great relevance to most of the key markets (think stocks, bonds, currencies).

The chart in question came from the latest edition of the Weekly Macro Themes report, which looked at the issue from a few angles in terms of the outlook for the Fed.

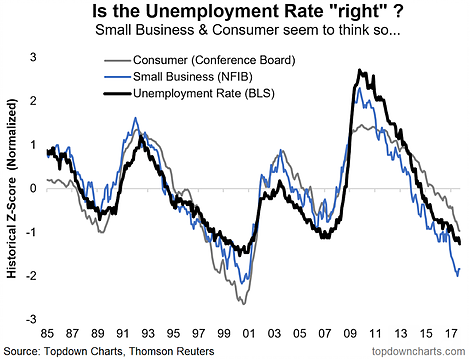

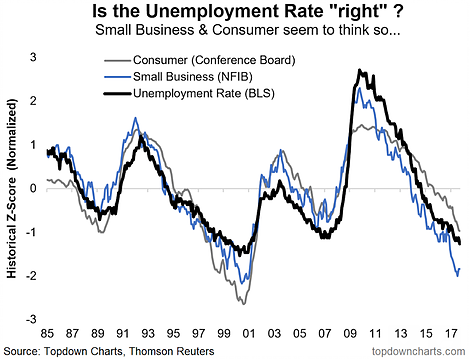

The chart shows the unemployment rate, standardized against its own history, alongside two key survey measures of labor market conditions.

Specifically, the chart is showing the historical z-scores (i.e. latest reading minus long-term average divided by long-term standard deviation). Looking at it this way allows an objective method of comparison between series across time. The black line is the unemployment rate from the BLS, the blue line is from the NFIB small business survey (whether firms are finding jobs difficult to fill), and the grey line is from the Conference Board consumer confidence survey (whether consumers say jobs are easy to find).

In my view, the signal from the unemployment rate is correct because we basically see in this chart independent verification from small businesses and consumers – two different parts of the economy and from two different perspectives (finding employees vs finding jobs).

The key implication is that by all 3 of these measures, the US labor market is looking very healthy indeed. The fact that the unemployment rate is comfortably below the NAIRU (Non-Accelerating Inflation Rate of Unemployment) also implies the jobs market is at full capacity, i.e. we’re already seeing full employment. This is a tight labor market.

Straight off the bat, this ticks the box on half of the Fed’s mandate, but it also means that wage inflation is likely to accelerate from here. Having come from such a deep and protracted downturn in the labor market though, it is likely to come with a lag.

Leave A Comment