Back in 2007, Edward Leamer published a paper titled “Housing IS the Business Cycle“. This one turned out to be pretty timely as the paper was published as the housing market was already falling apart and slowly pulling the US economy into the dumpster with it. It’s an appealing perspective especially within the context of today’s weak economic growth. With a weak recovery in housing, the national recovery looks weak. So goes housing, so goes the US economy.

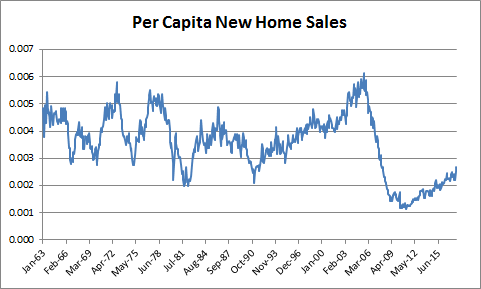

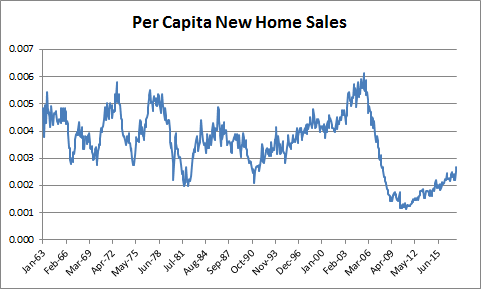

Today’s release of the surge in new home sales has people talking about a boom in growth. But I think we need to keep things in perspective. The financial crisis was an unbelievably damaging event. Here’s a look at new home sales adjusted for the change in population. We’re still at levels consistent with past recessions.

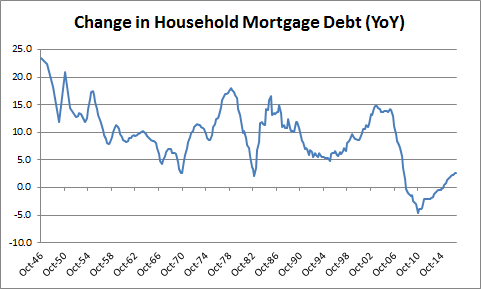

You can see the same basic story in household mortgage debt. This is important since, if the economy is comprised of balance sheets that expand over time in order to generate economic growth, then this is an essential element of growth since mortgage debt comprises 71% of household debt.

Here are some general takeaways from all of this:

Leave A Comment