Americans remain optimistic, and consumer spending in the US is holding up well.Data from First Data SpendTrend reveals an increase in consumer spending on an annual basis: +4.90% in September, +5.47% in August and +3.27% in July. This shows that, despite some variations, consumers remain in good shape and continue to support the economy through robust spending.The contrast with the situation in China is striking. Chinese consumer morale is still at half-mast. Although their level of savings continues to rise, this is not reflected in increased spending – quite the contrary:  In the three years of China’s property market slowdown, households have accumulated an additional 43 trillion RMB (around 6.1 trillion US dollars). This colossal sum represents almost a third of the country’s annual GDP!

In the three years of China’s property market slowdown, households have accumulated an additional 43 trillion RMB (around 6.1 trillion US dollars). This colossal sum represents almost a third of the country’s annual GDP!  Chinese savings are at an all-time high. For the moment, there seems to be no trigger to encourage households to spend. The downturn in the property market and the stock market has cooled consumers down, prompting them to prioritize savings over consumption.The slowdown in consumption in China is mainly due to the impoverishment effect caused by the fall in property prices, as well as the collapse of the Chinese stock market.The situation in the United States is completely different.American savings have melted away since the Covid crisis. Today, households, businesses and the government consume more capital than they produce. Since the first quarter of 2023, US national net savings have turned negative, a rare situation that has occurred only twice since 1947: between 2008 and 2011, and in 2020:

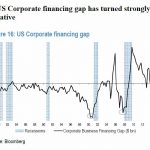

Chinese savings are at an all-time high. For the moment, there seems to be no trigger to encourage households to spend. The downturn in the property market and the stock market has cooled consumers down, prompting them to prioritize savings over consumption.The slowdown in consumption in China is mainly due to the impoverishment effect caused by the fall in property prices, as well as the collapse of the Chinese stock market.The situation in the United States is completely different.American savings have melted away since the Covid crisis. Today, households, businesses and the government consume more capital than they produce. Since the first quarter of 2023, US national net savings have turned negative, a rare situation that has occurred only twice since 1947: between 2008 and 2011, and in 2020:  The US economy is now entirely dependent on foreign capital.The United States currently consumes more than it produces, forcing it to turn to foreign capital to make up the difference. This level of contraction in US savings has always been associated with major economic crises:

The US economy is now entirely dependent on foreign capital.The United States currently consumes more than it produces, forcing it to turn to foreign capital to make up the difference. This level of contraction in US savings has always been associated with major economic crises:  However, the key element at present is the level of consumption. Americans are dipping into their credit and no longer saving, which is keeping consumption at high levels. This dynamic is helping to sustain US GDP.Savings levels in China are associated with low consumption, while near-zero savings in the USA coincide with sustained consumption. This dynamic is benefiting US markets.The S&P 500 continues to set record highs, and US equities are once again highly sought-after by investment funds:

However, the key element at present is the level of consumption. Americans are dipping into their credit and no longer saving, which is keeping consumption at high levels. This dynamic is helping to sustain US GDP.Savings levels in China are associated with low consumption, while near-zero savings in the USA coincide with sustained consumption. This dynamic is benefiting US markets.The S&P 500 continues to set record highs, and US equities are once again highly sought-after by investment funds:  Sustained U.S. consumer spending is boosting growth, allowing the U.S. to once again stand out from the rest of the Western world. The US economy also outperforms the Eurozone in terms of GDP, while Germany is dragging the continent into recession this quarter:

Sustained U.S. consumer spending is boosting growth, allowing the U.S. to once again stand out from the rest of the Western world. The US economy also outperforms the Eurozone in terms of GDP, while Germany is dragging the continent into recession this quarter:  The good US economic results are also attributable to the federal stimulus package, which has propelled debt to a new record high.Fiscal year begins on a sour note!On the very first day of the new fiscal year, the federal debt exploded, rising by $204 billion to a new high of $35.669 trillion:

The good US economic results are also attributable to the federal stimulus package, which has propelled debt to a new record high.Fiscal year begins on a sour note!On the very first day of the new fiscal year, the federal debt exploded, rising by $204 billion to a new high of $35.669 trillion:  However, the situation is even more worrying for the Treasury: the US government also had to draw $72 billion from its cash reserves on the first day of the fiscal year.All in all, the United States racked up a deficit of over $275 billion in a single day, a record figure.With the exception of the health crisis, the US federal debt has never increased so much in such a short space of time.Since June 2023, the federal debt has exploded by $4 trillion, an increase of 14% in just a few months!During the same period, U.S. GDP grew by only $1.5 trillion, or around 6%.In other words, the national debt has grown almost three times faster than economic growth over the past 16 months, which is unsustainable.The good health of the US economy, in stark contrast to the Chinese and European economies, is due to the optimism of American consumers and the unprecedented support of the government, which has made massive use of credit to finance its growth.These figures show the extent to which this support plan cannot continue after the US elections, whatever the outcome.The optimism of the American consumer is also very fragile, as it relies on his ability to borrow and on the wealth effect he perceives.This wealth effect is currently under threat: as in China, a downturn in the real estate market and the stock market would lead to a radical change in US consumer behaviour.It is probably this fragility that is driving US funds to continue buying gold. Gold ETF outstandings in the United States are up for the third month running:

However, the situation is even more worrying for the Treasury: the US government also had to draw $72 billion from its cash reserves on the first day of the fiscal year.All in all, the United States racked up a deficit of over $275 billion in a single day, a record figure.With the exception of the health crisis, the US federal debt has never increased so much in such a short space of time.Since June 2023, the federal debt has exploded by $4 trillion, an increase of 14% in just a few months!During the same period, U.S. GDP grew by only $1.5 trillion, or around 6%.In other words, the national debt has grown almost three times faster than economic growth over the past 16 months, which is unsustainable.The good health of the US economy, in stark contrast to the Chinese and European economies, is due to the optimism of American consumers and the unprecedented support of the government, which has made massive use of credit to finance its growth.These figures show the extent to which this support plan cannot continue after the US elections, whatever the outcome.The optimism of the American consumer is also very fragile, as it relies on his ability to borrow and on the wealth effect he perceives.This wealth effect is currently under threat: as in China, a downturn in the real estate market and the stock market would lead to a radical change in US consumer behaviour.It is probably this fragility that is driving US funds to continue buying gold. Gold ETF outstandings in the United States are up for the third month running:  Gold purchases by US investors support gold prices, despite renewed rise in interest rates and the dollar.US 10-year interest rates are back above 4%, despite the Fed’s 50 basis point cut:

Gold purchases by US investors support gold prices, despite renewed rise in interest rates and the dollar.US 10-year interest rates are back above 4%, despite the Fed’s 50 basis point cut:  The dollar is back on the rise, with the DXY index once again well above the 100-point threshold:

The dollar is back on the rise, with the DXY index once again well above the 100-point threshold:  Gold’s performance, which remains close to its highs, is quite remarkable in this context:

Gold’s performance, which remains close to its highs, is quite remarkable in this context:  More By This Author:Gold Breakout In CHF: UBS Recommends Allocating 5% Of Your Portfolio To The Yellow Metal Is China Building An American-Style Stock Market? The Rise Of Emerging Countries: Towards A New Global Balance?

More By This Author:Gold Breakout In CHF: UBS Recommends Allocating 5% Of Your Portfolio To The Yellow Metal Is China Building An American-Style Stock Market? The Rise Of Emerging Countries: Towards A New Global Balance?

Leave A Comment