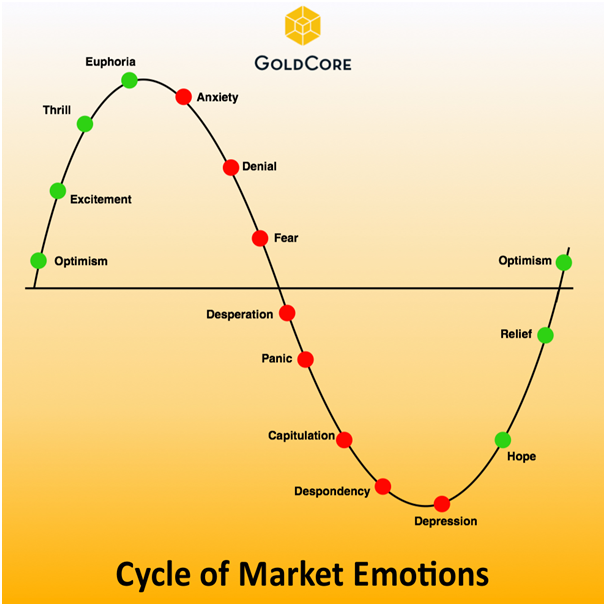

Cycle of Emotions – Hope Phase Now (GoldCore)

Earlier this week Shelley Goldberg , commodities strategist for Roubini Global Economics wrote about how gold was set to disappoint the ‘gold bulls – again.’ Goldberg argued that we should ‘throw out all the fancy analysis and realize that gold is an emotional trade.’

Aside from yesterday’s little hiccup following the Fed announcement, the gold price has had a great year. Goldberg agrees, ’After breaking through a six-year downtrend line, gold rose last week to its highest level since Nov. 4, and is up an impressive 10.5 percent this year.’

Despite this performance Goldberg argues that we shouldn’t ‘believe the hype’ when it comes to gold. The hype she is referring to seems to be made up of the various op-eds and analysis that argue $1,300/oz is a key barrier for the metal to break through in order to set off on a bull run.

A very straightforward presentation of the ‘number of reasons why gold is in demand’ makes up the bulk of Goldberg’s article, yet she concludes ‘with so many valid reasons for gold to rally further, why am I a doubter? The most rudimentary reason is that gold is also an emotional trade and $1,300 is a round number. One need not be a superstar technical analyst. Just consider that for both psychological and systematic reasons, traders and algorithms like to sell on landmark numbers that also serve as a testing ground for a rally’s sustainability.’

Is the evidence that traders like to trade off ‘landmark numbers’ but analysis says it should go higher evidence that there is ‘hype’? We disagree. Rather we argue that not only is there relatively little hype in the gold market but that it is significantly outshone by all the reasons Goldberg gives herself, for why gold demand is up.

Where is the hype?

A brief google search of ‘$1,300 gold’ and my own daily experience of reading gold commentary does not bring me to the conclusion that there is hype. Gold has had a great year, but it has also surprised and disappointed many of us for the last couple of years. We are all aware that $1,300 is the next significant level, but most think that it needs to go higher than this in order to get any significant momentum.

Leave A Comment