With the biotech sector behaving much better recently, it is time to look into if a bottom has formed and new investments in the market are warranted. Also, Bret Jensen addresses two other questions that many of his readers have asked him recently about the sector.

Here are three questions that I have received from many of my followers and that I would like to address and answer.

1. Do I believe the biotech sector is finally starting to bottom?

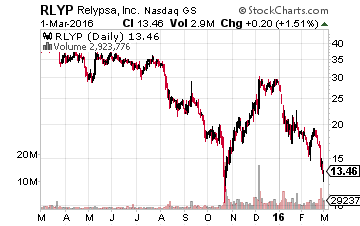

2. What is my take on Relypsa now that it has had its first quarterly report with its just approved drug veltassa seeing initial sales?

3. How am I investing in this sector currently?

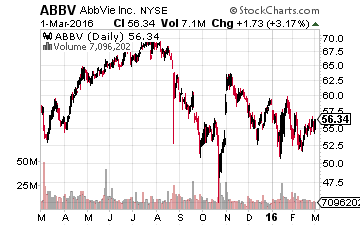

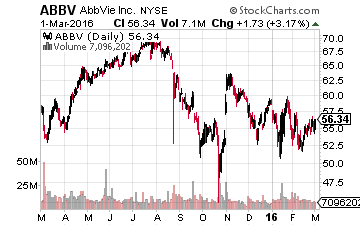

Let me address the first question by saying this sector has had so many false starts that to say for sure the sector has bottomed after a few good days of market action would be bad judgement. What I will say, however, is that the valuations on large cap names like

Gilead Sciences (Nasdaq: GILD) or AbbVie (NYSE: ABBV) are lower than they have been in five years. If we are not at a bottom, it feels like we are getting very close.

Citigroup echoes this view and came out stating they thought biotech was near bottoming. They also said, “While the pricing debate may not go away in near term, especially in an election year, we do not think the ground reality on pricing will change anytime soon and see limited real impact on pricing.” This is something I have been saying for some time as this is not my first rodeo and the attacks on the pharma and biotech sectors seem to be in the standard playbook of politicians every election season.

Here is my take on Relypsa (Nasdaq: RLYP). The sell-off to their conference call was an overreaction and the shares have rallied some from the pullback. Initial scripts, while not the “1,700” figure that has been flying around social media, were a very respectful 1,209. Script growth in early February was double that of January and should continue to grow as the company gains reimbursement coverage from contracts with large PBMs like Express Scripts (Nasdaq: ESRX) and coverage within government programs like Medicare, which is happening quite rapidly.

Leave A Comment