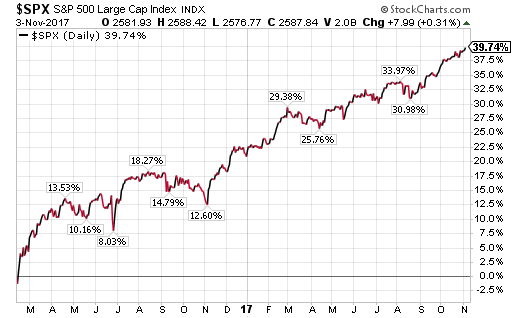

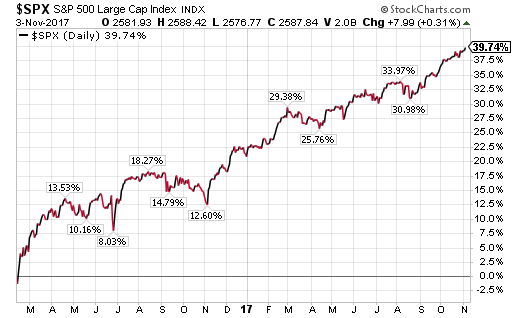

I read an individual’s commentary this weekend that was titled Is This As Good As It Gets, and I will have more comments on this later in this post, but it coincides with some clients/investors inquiring whether they should raise cash now. The ‘raise cash now’ question is certainly understandable when one looks at the strength of the market since the February low last year, up nearly 40% on a price only basis in less than two years.

As I have noted in some recent posts, the most recent one here, the important thing investors should do at this point in time is review their overall asset allocation. If the market strength has caused the equity exposure to exceed ones comfort level, now is a good time to adjust their portfolio by reducing equity back to a comfortable target. Instead of having maybe three or so months of liquidity to fund expense needs, maybe that liquidity should be increased to nine to twelve months if that enables you to sleep better at nigh. Timing the market is difficult, time in the market is important.

The author of the commentary noted at the beginning of the post is Jeff Miller and he writes a weekly article referred to as Weighing The Week Ahead and it is a worthwhile weekly read. This week’s commentary noted many positives from economic ones to corporate earnings. In his ‘Final Thoughts’ section he concludes:

“Can we expect to identify market tops from the record strength in economic indicators? No…

“When indicators and markets finally roll over and get worse, we will be able to look back and spot the “top.” That is much different from a real-time forecast. The current level of economic strength can continue or improve – perhaps for years. Many pounce on the first decline in an indicator and leap to an unwarranted conclusion.

“Trying to guess the top (or bottom) from improving (or worsening) indicators is a fool’s errand.

“Stocks are driven by earnings and interest rate expectations. These factors remain favorable…”

Leave A Comment