This time is different. They always say so. But what if they are eventually right? We invite you to read our today’s article about the history of the Fed’s tightening and find out what is exceptional with the current cycle. And what does it mean for the gold market.

When reading about the economic outlook, one can often find a sentence that “this time is different”. We don’t agree with that on the general level: after the boom, there is always a recession. Period. There ain’t no such thing as a free lunch. And there ain’t no such thing as endless easy money, as Carmen M. Reinhart and Kenneth S. Rogoff brilliantly pointed out in their book This Time Is Different. Eight Centuries of Financial Folly. They showed that financial crises strike with surprising repeatability. But experts and investors each time claim that “this time is different”, i.e. the old rules of financial valuation and economics no longer apply and that the new situation is not similar to the previous disasters. These experts are clearly wrong.

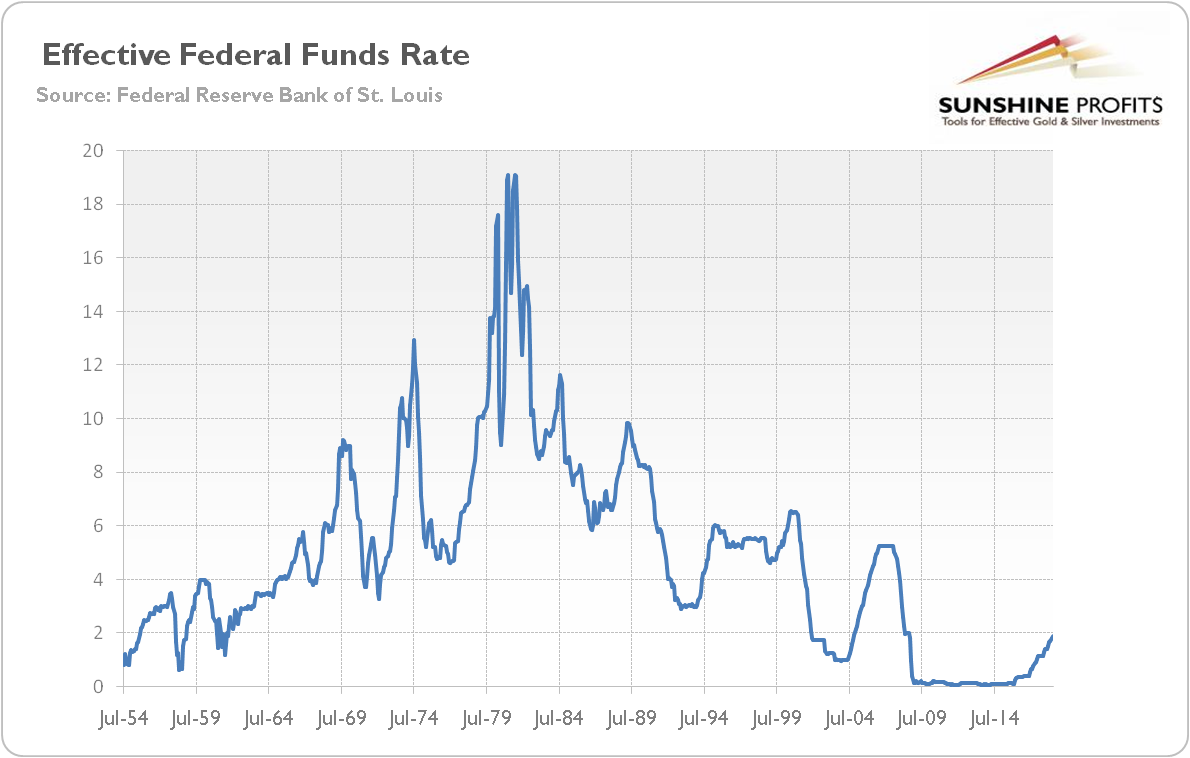

However, we sometimes claimed that this time really might be different in a certain sense. What we mean here is that the current tightening cycle is exceptional. Why do we claim that? Let’s take a look at the chart below, which displays the federal funds rate since the 1954.

Chart 1: Effective Federal Funds Rate from July 1954 to July 2018.

As one can see, the current tightening cycle is unprecedented. After keeping the interest rates at almost zero for seven years, the Fed was able to hike them merely by 1.75 percentage points during almost three years (or 2 percentage points, if we add the very likely upward move in September). In the past, the Fed was less gradual and more decisive, as it can be deducted from the slope of the line. But let’s dig into the data.

In the previous cycle, the Fed increased the interest rates by 4.25 percentage points in two years. If the Fed hiked now in the similar pace, the target range of the interest rates would be about 5.25-5.50. In the tightening cycle of 1999-2000, the US central bank lifted rates from 4.75 to 6.50, or by a 1.75 percentage points, the same as in the current tightening cycle. But over twelve months! Let’s move on. From January 1994 to March 1995, or in just 15 months, the Fed raised interest rates by 3 percentage points. Previously, the US central bank was even more aggressive: from April 1988 to March 1989, i.e. in twelve months, Alan Greenspan increased the federal funds rate by 3.25 percentage points.

Leave A Comment