There are no shortage of Warren Buffett quotes on successful investing. The one that never fails to reassure me? “Be fearful when others are greedy and greedy when others are fearful.”

If one of the greatest investors on the planet strongly suggests that one become risk averse when the herd is throwing caution at the proverbial wind, it makes sense to identify the extent of ill-advised risk taking. For example, the CBOE S&P 500 VIX Volatility index (a.k.a “fear gauge”) closed out September at its lowest level on record, suggesting that there is very little regard for the possibility of a precipitous stock decline.

Other fear-greed measures are equally disquieting. In spite of a flawless run-up since the November election, where stocks have catapulted higher for 11 consecutive months, sixty-five percent of Americans believe that stocks will rise over the next 12 months. This particular percentage of optimism (65%) represents a record level of confidence in equities.

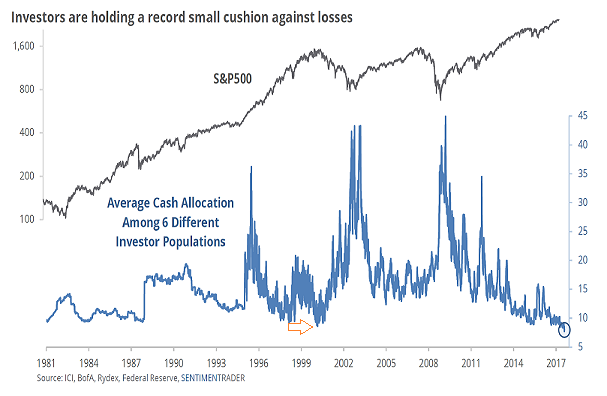

Perhaps the most compelling evidence? Cash allocation levels. Cash levels have moved to record lows – levels that are reminiscent of the dot-com tech bubble (2000) and subsequent recession (2001).

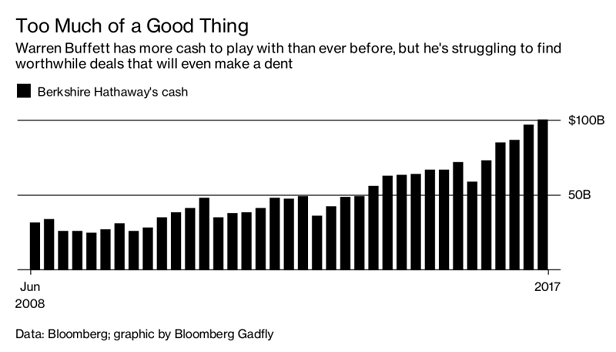

Not surprisingly, Warren Buffett has become risk averse with his holding company, Berkshire Hathaway (BRK-A). He is not adding meaningfully to current positions. He is not putting billions to work in new positions or acquisitions.

On the contrary. While the typical investor has never had more confidence in putting his/her cash into riskier assets like stocks, Mr. Buffett has never had more of his money sitting in the safety of low yielding cash.

Warren Buffett’s cash allocation likely reflects another one of his timeless principles. The quote? “Rule Number 1: Never lose money. Rule Number 2: Never forget Rule Number 1.”

In particular, cash is one of the most effective hedges against the risk of severe financial loss. You also get to use it to scoop up incredible bargains at lower prices.

Leave A Comment