The October 2016 ISM® Manufacturing Report shows growth was nearly flat for the month at 51.9 vs. the September reading of 51.5.

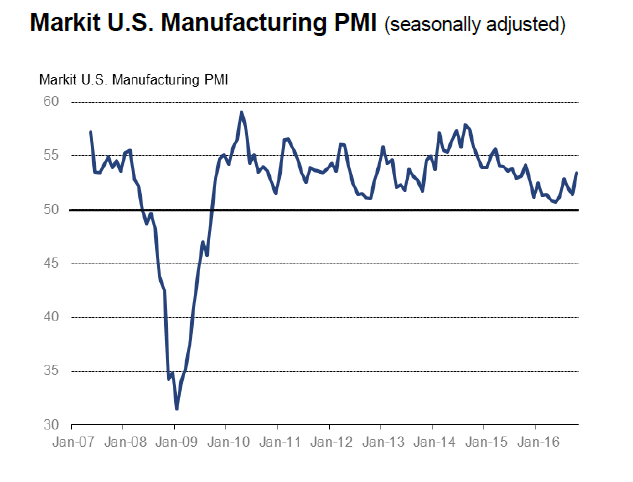

Markit’s US Manufacturing PMI was 53.5, the best reading in a year.

Both reports showed input price pressures. Markit noted the biggest rise in input prices in five years.

ISM Manufacturing Numbers

| ISM Manufacturing October 2016 |

| Index |

Oct |

Sep |

PP Change |

Direction |

Rate of Change |

Trend in Months |

| PMI® |

51.9 |

51.5 |

0.4 |

Growing |

Faster |

2 |

| New Orders |

52.1 |

55.5 |

-3.4 |

Growing |

Slower |

2 |

| Production |

54.6 |

52.8 |

1.8 |

Growing |

Faster |

2 |

| Employment |

52.9 |

49.7 |

3.2 |

Growing |

From Contracting |

1 |

| Supplier Deliveries |

52.2 |

50.3 |

1.9 |

Slowing |

Faster |

6 |

| Inventories |

47.5 |

49.5 |

-2.0 |

Contracting |

Faster |

16 |

| Customers’ Inventories |

49.5 |

53.0 |

-3.5 |

Too low |

From Too High |

1 |

| Prices |

54.5 |

53.0 |

1.5 |

Increasing |

Faster |

8 |

| Backlog of Orders |

45.5 |

49.5 |

-4.0 |

Contracting |

Faster |

4 |

| New Export Orders |

52.5 |

52.0 |

0.5 |

Growing |

Faster |

8 |

| Imports |

52.0 |

49.0 |

3.0 |

Growing |

From Contracting |

1 |

Markit US Manufacturing PMI

Key Findings

Gains in output and new orders underpin sharp improvement in operating conditions

Jobs added again, albeit at modest pace

Cost inflation rises to highest level for two years

Comments From Chris Williamson, Markit’s Chief Business Economist

“October saw manufacturing enjoy its best performance for a year. Factories benefitted from rising domestic and export sales, driving output higher to mark an encouragingly strong start to the fourth quarter.”

“The survey also picked up signs of manufacturers and their customers rebuilding their inventories, often filling warehouses in anticipation of stronger demand in coming months.”

“However, a widespread reticence to take on extra staff highlights lingering caution with respect to investing in capacity, at least until after the presidential election.”

“Hiring is also being subdued partly by worries about escalating costs, with the October survey recording the largely monthly rise in factory prices for five years.”

“While output growth is accelerating, so too are inflationary pressures, which will further fuel speculation that the Fed will hike interest rates again in December.”

Leave A Comment