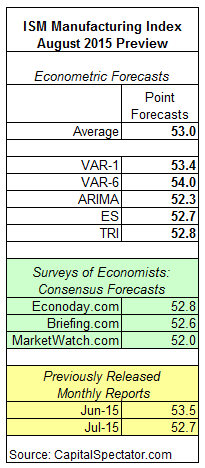

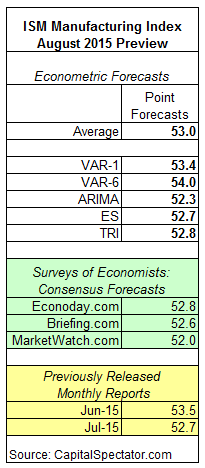

The ISM Manufacturing Index is expected to tick higher to 53.0 in tomorrow’s update for August vs. the previous month, based on The Capital Spectator’s average point forecast for several econometric estimates. The prediction is moderately above the neutral 50.0 mark and so the current outlook still translates into a forecast of growth for this benchmark of economic activity in the US manufacturing sector.

Meanwhile, three consensus estimates based on recent surveys of economists anticipate a mix of outcomes for today’s update, ranging from a fractional gain to a modest decline in the rate of growth for the August ISM data relative to the previous month. In all cases, these estimates are below The Capital Spectator’s average projection.

Here’s a closer look at the numbers, followed by brief summaries of the methodologies behind the forecasts that are used to calculate The Capital Spectator’s average prediction:

VAR-1: A vector autoregression model that analyzes the history of industrial production in context with the ISM Manufacturing Index. The forecasts are run inR with the “vars” package.

VAR-6: A vector autoregression model that analyzes six economic time series in context with the ISM Manufacturing Index. The six additional series: industrial production, private non-farm payrolls, index of weekly hours worked, US stock market (Wilshire 5000), spot oil prices, and the Treasury yield spread (10 year Note less 3-month T-bill). The forecasts are run in R with the “vars” package.

ARIMA: An autoregressive integrated moving average model that analyzes the historical record of the ISM Manufacturing Index in R via the “forecast” package.

ES: An exponential smoothing model that analyzes the historical record of the ISM Manufacturing Index in R via the “forecast” package.

Leave A Comment