In previous articles, we’ve discussed how emerging markets are outperforming America after several years of underperformance. Emerging markets usually have a lower PE multiple than America and developed markets because their capital markets aren’t as trusted and their political systems are more uncertain. Lately, there has been a silly narrative that because President Trump appears seemingly volatile and Congress isn’t getting much legislation passed that the American political system is uncertain. If not getting new laws passed is the biggest worries, it’s not a big deal. The lack of political risk means America’s risk of becoming the next Venezuela is lower than emerging markets like Brazil which has seen many leaders go down because of corruption scandals recently. America and other developed markets may be prone to populism, but it’s nothing like the emerging markets.

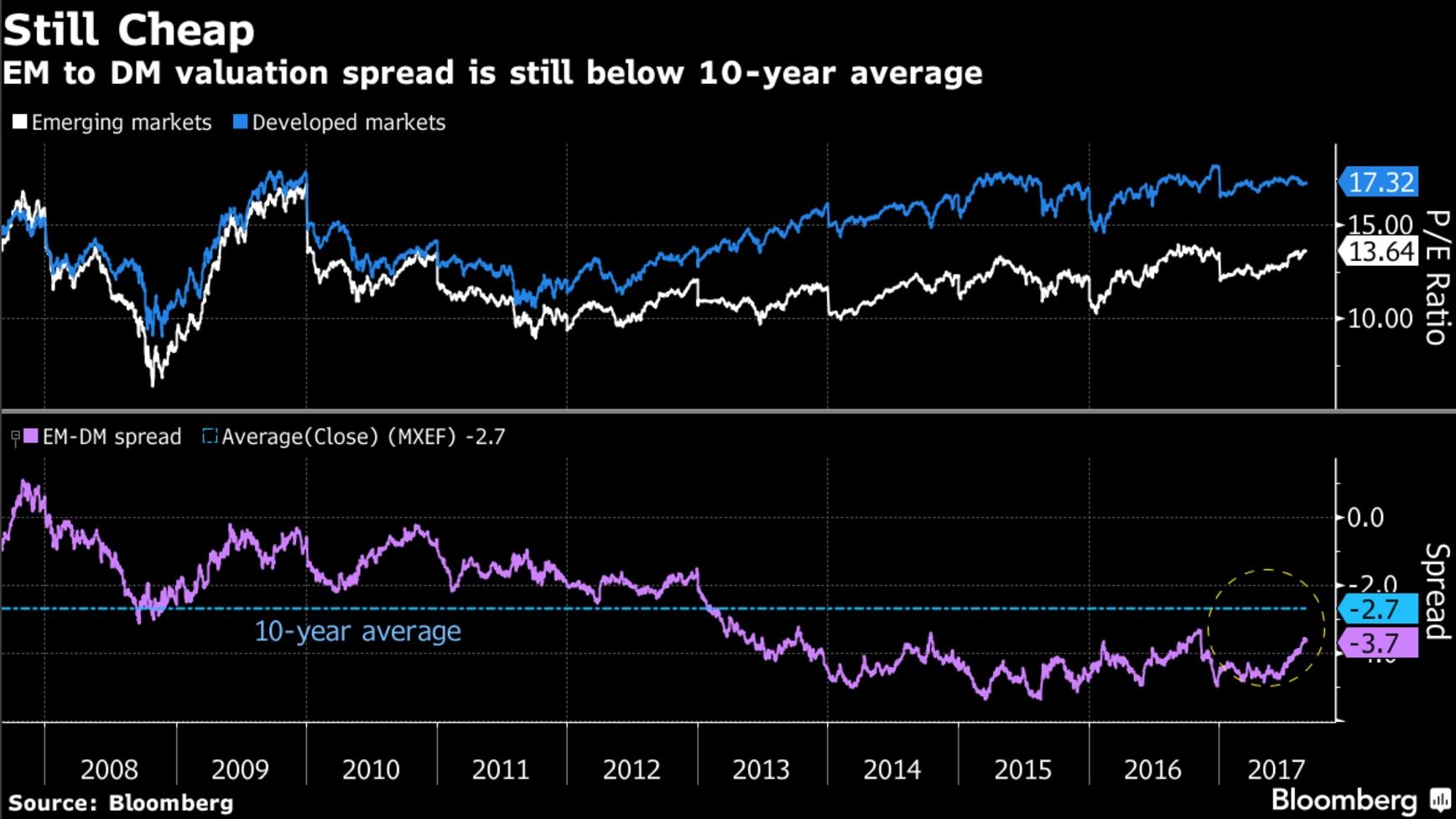

As you can see from the chart below, the average spread between developed and emerging market multiples is 2.7 points. It’s now at 3.7 points which means despite the rally this year, emerging markets might have more room to run. Much of this is driven by China which is finally seeing GDP growth stabilization. If China has a great 2018, this gap will be closed. If the global economy continues to grow, commodity prices will accelerate which should have a net positive effect on emerging markets which are commodity exporters.

Economic News

The August manufacturing ISM PMI was an amazing report as it came in at 58.8. That beat the consensus estimate of 56.6. The high end of the consensus was 57.5, which it beat. This was the highest headline PMI report in the past 12 months. A report of 58.8 is equivalent to 4.9% GDP growth. Clearly, there’s no chance in the world the GDP report comes in at 4.9% for Q3. However, the point is to show the manufacturing economy is doing well. The chart below breaks down the subsets of the report. As you can see, most of the reports are showing faster growth. This great report might have been one of the reasons why the stock market rose despite the weak labor market report.

![He’ll Bring Them [Inflation], And They Will Love Him For It](https://www.riceoweek.com/wp-content/uploads/2017/01/cme-150x150.png)

Leave A Comment