Securities Analysis by Graham and Dodd remains one of my all-time favorite investment books. While I have long given up on the “find a stock trading below book value and wait for the market to catch-up” strategy, I remain a fan of the book’s central idea that an investor can ascertain a great deal of information by tearing apart the company’s financials. “It’s a numbers game” columns are devoted to primarily using financial statements as a way to discern between competing companies.

According to dividend.com, the list of dividend aristocrats (stocks that have raised their dividend at least 25 consecutive years) includes the following three consumer product companies: Kimberly Clark (KMB), Procter & Gamble (PG), and Colgate Palmolive (CL). This column assumes that an individual investor can only buy one of them and wants to determine which one is the best buy.

Ultimately, this is about growth and efficiency: which company is growing the fastest (or, more precisely, shrinking the least) while also having higher average margins. We also want to know about interest payments as they relate to operating income. In an rising interest rate environment, we want the lowest ratio because that company will be least impacted when they refund their debt. Finally, there’s the all-important payout ratio, dividend yield and price performance.

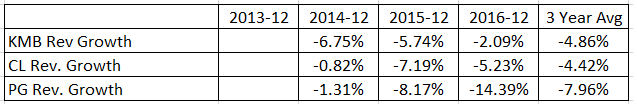

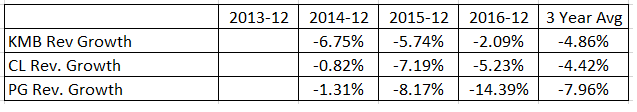

Let’s start with revenue growth (data from Morningstar.com; author’s calculations):

First, note that all of them are losing revenue. This is largely the result of the “Amazon (NASDAQ: AMZN) effect” that is hitting all companies in the retail sector right now. However, Colgate Palmolive is losing the least.

Next up are the gross margins:

There is no comparison here; Colgate has — by far — the best gross margin by slightly over 9%.

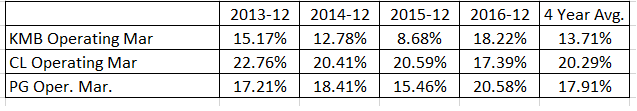

Next, let’s turn to the operating margin:

Colgate beats the competition, but by a smaller margin: 2.38%.

Leave A Comment