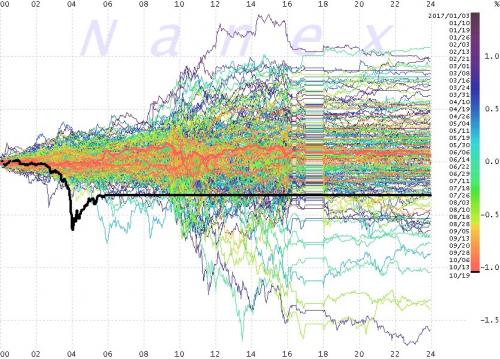

As Nanex’ Eric Hunsader shows, today’s trading session is shaping up – at least for now – as the biggest post-midnight selloff in the S&P in 2017.

With a notable risk-off tone…

Yield Curve Inverts, Yuan Slides As China GDP Growth Slows

Despite all the talk of deleveraging, China did anything but according to its most recent data but the lagged impact…

The selloff is global…

AsiaPac…

Europe…

And US…

Of course, after months of calm acquiescence to the melt-up in global risk assets, a modest drop like today’s needs a narrative to explain it – in order that bullish asset-gatherers can thusly dismiss the fears as ‘one-offs’ and reiterate how the central banks will step in if things get worse… here are your catalysts du jour…

As Alexandre Baradez, chief market analyst at IG France, notes,

“It’s a synchronized risk-off move for stocks, with gold, the yen, the Swiss franc rallying, right on the day of the Black Monday anniversary…

There hasn’t been a clear trigger in the news this time, rather of mixed negative elements, including worries that Trump won’t be able to deliver on tax cuts anytime soon.”

Leave A Comment