At times like these when it seems as if the world has been so simplified, it is useful to remind yourself that it is dangerous to think it will remain that way. That is the path that leads to orthodox economics where ideology alone dictates that you know everything that is worth knowing. If there is one constant of the eurodollar system, it is the opposite – it doesn’t stand so still. That warning even applies just when you think you have everything “clocked.” What disturbs me most is that I don’t know what I don’t know.

It starts with the realization that everything is hidden even when it seems on those rare occasions as if it is not. At best, we are dealing with what we hope in the end are reasonable guesses, but guesses nonetheless. There is so much undiscovered detail that it is unwise to ever be so confident.

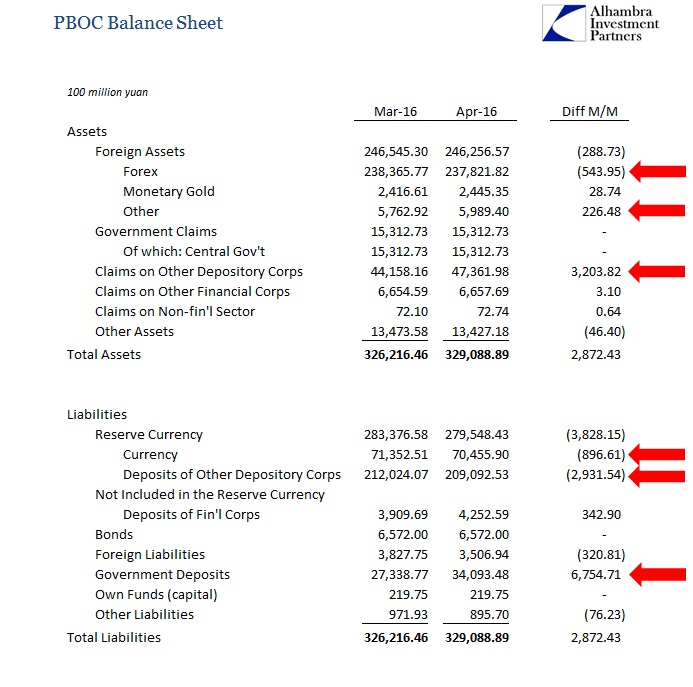

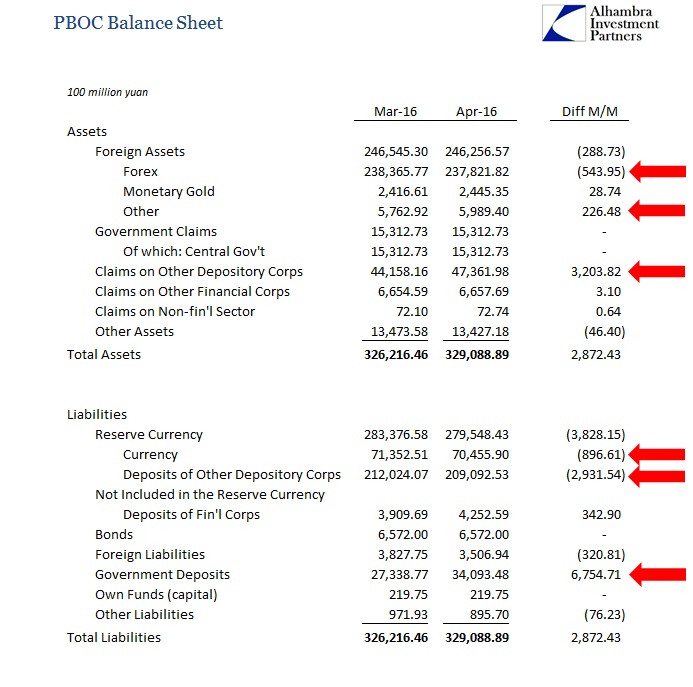

At this moment, we have CNY acting predictably and now the PBOC updates its own behavior in the same fashion. The most important piece of the latest balance sheet figures for April is that once again bank reserves in China declined just as we suspected it would related to the “ticking clock.” Further, the proximate cause of the drop was a sharp increase in government deposits; that isn’t the problem for Chinese liquidity, however, as it indicates instead the general illiquidity everywhere else that the PBOC did not expand its balance sheet elsewhere to accommodate the central government.

Not for lack of any effort, though, as there was a RMB 320 billion increase in the medium term liquidity programs (claims on other depository corporations). However, just like last March when the whole internal system of bank reserves suddenly turned around to where reserves would suddenly decline regularly, there is no indication as to why the PBOC didn’t expend more effort to head off harmful liability side redistribution. It is that part that worries me the most, as it suggests that though we might have found some assumed degree of predictability and comfort with understanding there is “something” else missing – perhaps very big and important.

Leave A Comment