Whether it is due to contagion from the latest emerging markets sell-off, or growing concerns about Italy’s budget demands, another market that has gotten whacked on Thursday is the Italian bond market where BTP futures have reversed earlier post-auction gains, dropping to a day low as risk-off sentiment spreads across markets.

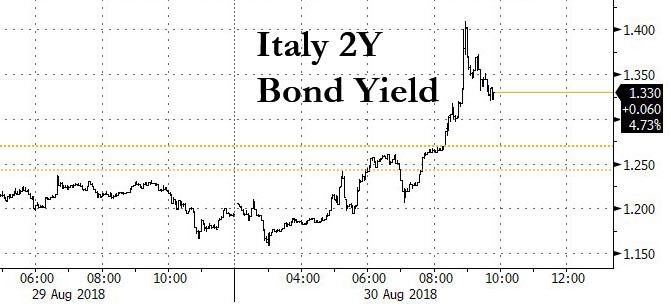

As a result, the Italian curve is bear flattening, with the 2y +14bps to 1.30%…

… and the 10y BTP yield has jumped +8bps to 3.30%; 5y +5bps to 2.45%;

Futures are selling off across the board.

Today’s selling brings the 10Y yield to the level last seen during the furious May sell-off.

Speaking to Bloomberg, one London-based trader sees selling at the long-end of the BTP curve, though “no specific catalyst evident.”

Should the EM carnage accelerate, keep a close eye on Italy to see if contagion spreads to the weakest of the core markets.

Leave A Comment