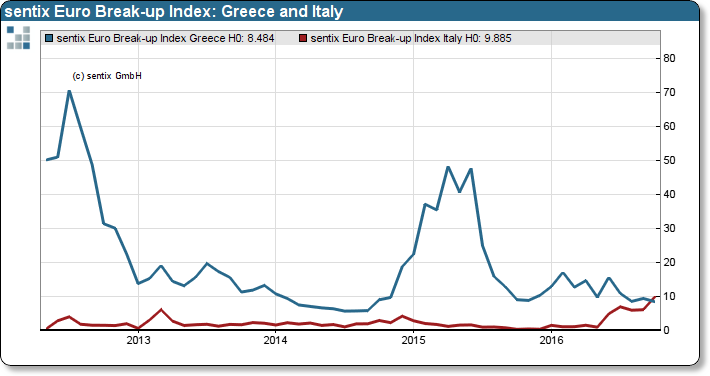

In an unexpected reversal of (mis)fortune, this morning Sentix writes that the Eurocrisis creeps back into the heads of the investors in a new way: it is no longer Greece, but Italy which is now the country that is most likely to leave the Eurozone within the year from the perspective of the more than 1,000 investors surveyed. “This development underscores the importance of the referendum to the Constitution in Italy on December, 4th.”

Sentix adds that while it looked as if a “castle peace” had been concluded a few months ago, the euro concerns are gradually rising again among investors. But this time it is not Greece that dominates the agenda. Although for example the pension funds in Hellas are collapsing, the euro exit probability has fallen to 8.48% – the lowest level since 2014.

Italy is now the focus country number 1 in the Eurocrisis! The precarious situation of the Italian banks, the political questions surrounding the Constitutional Treaty at the beginning of December, and the economic turmoil of the past have placed the country south of the Alps at the center of investor interest.

The above graph shows the historical dimension that is inherent in this signal. And it shows that this is not a one-off event, due to an up-to-date message, as we observed in the Netherlands, for example, after the Brexit decision.

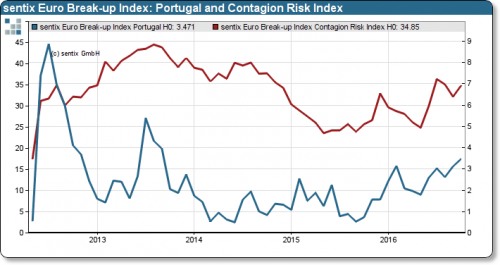

Besides Italy, Sentix also measure a disadvantageous trend in Portugal. While the exit probability is not very high here, the EBI value worsens in small but steady steps. Thus, the risk of contagion as measured in the “Contagion Risk Index” also come back to the agenda.

And with the Italian referendum coming up fast, scheduled for December 4, the market is starting to noticed. Earlier today, Italy’s borrowing costs hit eight-month highs with investors focused on political risks and stuttering banking sector reforms there as anxiety about other lower-rated euro zone nations has eased, Reuters writes. The formation at the weekend of a minority Spanish government after a 10-month political stalemate has prompted markets to throw the spotlight east to Italy instead for what could be a nervy year-end.

Leave A Comment