Bulletin headline summary from RanSquawk

JPMorgan’s warning that the Chinese rout is far from over “as 2018 becomes 2015” proved prescient, and overnight global sentiment quickly shifted to “risk off” as soon as China opened for trading, leading to a resumption of selling first in China, then across Asia, and finally around the world, resulting in a market snapshot which this morning is another sea of red ahead of this Friday’s deadline for the US-Chinese trade war, when 25% tariffs kick in on some $34 billion in Chinese exports to the US.

The underlying concerns are well known: trade-war jitters, political risk in Europe and divergence in fiscal and monetary policy and economic performance between the US and the rest of the world weighed on investors’ minds.

“It’s not a happy start to the second half,” Saxo commodity head Ole Hansen said. “Trade war concerns, U.S. sanctions, Trump’s rants and political problems in Europe, as well as worries about slowing emerging-market growth are all playing their part.”

Political risks dragged the euro and pound down, the Mexican peso’s rally was short-lived after the election of the country’s first leftist president in decades, while Treasuries climbed and dollar strength again slammed emerging markets. Overnight, Mexico’s Andres Manuel Lopez Obrador won a decisive victory in the Presidential election with quick count results showing he received 53.0%-53.8% of votes, while an exit poll also showed that Lopez Obrador is set to get a majority at the lower house.

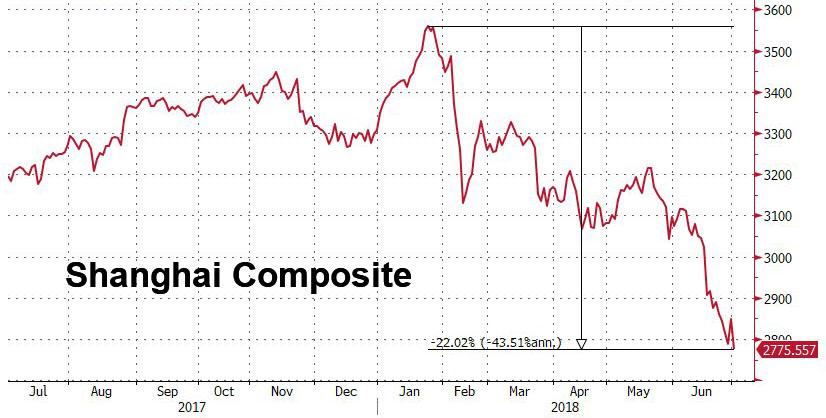

Once again, it started with China, whose stocks took another battering on Monday as selling returned amid concern about a falling currency, housing curbs and the impact of trade tariffs. The Shanghai Composite Index extended last month’s 8% rout – with real estate and bank stocks heavily offered as leverage and credit exposure is under increasing pressure – sliding another 2.5% on Monday and bringing its bear market rout to -22% since the January high..

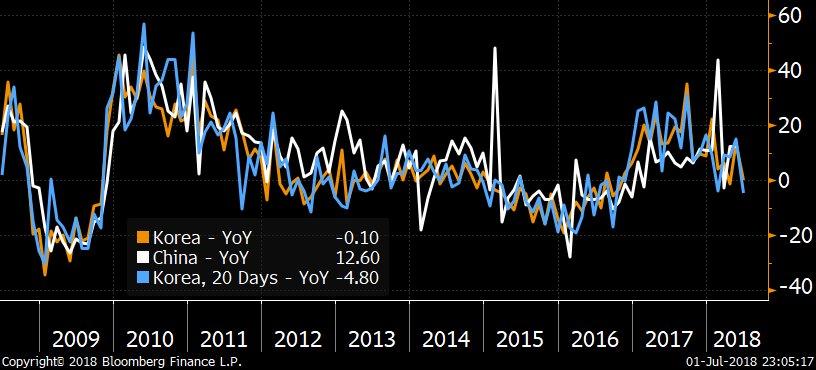

… while the yuan touched its weakest level since Oct. 3, resuming its sharpest drop since China’s August 2015 devaluation….

… after another unexpectedly sharp overnight selloff, sent the offshore Yuan down 0.6% to 6.6760 and fast approaching the 6.70 barrier.

What is curious is that the PBOC set the Yuan stronger than the expected fixing, suggesting that China is not yet using yuan depreciation as an active tool in its trade conflict with the U.S., and will likely step in to avert any disorderly decline, according to Morgan Stanley. “The PBOC could step up intervention if depreciation risk intensifies,” according to China economists at the bank, led by Robin Xing in Hong Kong. Goldman strategist on Friday also concluded that the PBOC has been “leaning against excessive depreciation in recent days.” We wonder what will happen if China decides to lean in…

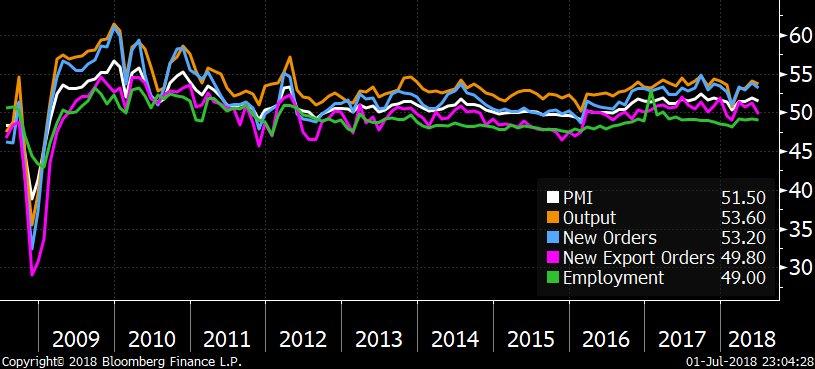

Adding to concerns about China, over the weekend, China’s June PMI indicated weaker-than-expected manufacturing data and showed that new export orders slid into contraction, suggesting that trade war concerns are starting to seep through the Chinese economy.

Italian bonds made the European party complete with BTP futures sliding again, as yields rose as much as 9bps across 2- to 10-year sectors, widening vs core bonds as risk appetite continues to sour following European open.

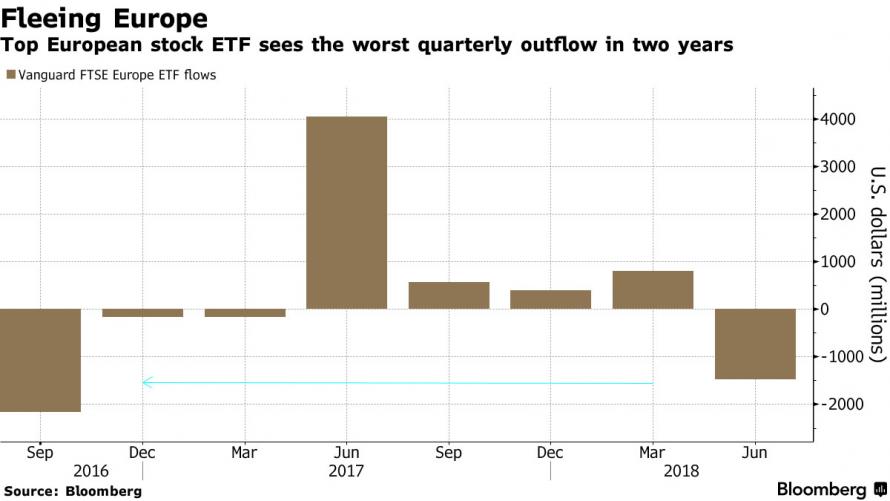

Needless to say, investors are no longer enamored with Europe, which in Q2 saw the biggest quarterly ETF outflow in 2 years.

The US wasn’t immune to the global rout and futures on the S&P 500, Nasdaq and Dow all dropped, with the S&P set to erase all of Friday’s gains (which were far less as a result of that last hour selling rush).

There was more turmoil in FX: after rallying the most in a month Friday, the euro slipped -0.4% on Monday, erasing all earlier losses, as concern about a potential escalation in the German political crisis provides investors with another reason to fade rallies. On Monday, Merkel’s CDU and Bavarian CSU are holding last-ditch talks to reach a compromise over migration policy disputes.

On Sunday, Germany Interior Minister and CSU party leader Seehofer offered to resign, which follows a meeting over the weekend with Chancellor Merkel that Seehofer described as pointless and in which he rejected the migration deal that was negotiated at the EU summit. However, reports later stated that Seehofer is said to remain in politics if Chancellor Merkel’s CDU party backs down regarding migration, while he also said he wants to avoid the collapse of Merkel’s government and is said to be seeking one more discussion with the CDU. SU caucus chief Dobrindt opposed the resignation and requested an internal vote, while there were also comments from Economy Minister Altmaier who stated that the German coalition is in a serious situation.

Leave A Comment