Even though trade tensions, particularly between the US and China, have heated up, small-caps – supposed beneficiaries of a trade war – have stalled of late. Medium term, downside risks are huge. In the very near term, it is a toss-up – kind of range-bound. An iron fly fits the bill.

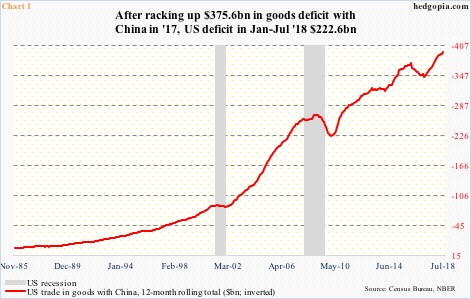

In July, the US racked up $36.8 billion in goods deficit with China – a record. This was made up of $10.3 billion in US exports and $47.1 billion in imports. This nothing but helps add fuel to the ongoing US-China trade-tension fire.

On a 12-month rolling total basis, since Donald Trump was elected US president in November 2016, US goods deficit with China has grown by $46.3 billion to $393.5 billion. In 2017, the deficit was $375.6 billion. Year-to-July, it already totals $222.6 billion.

As tensions heat up, both China and the US have imposed tariffs on $50 billion of each other’s goods. Last Friday, President Trump said his administration was ready to impose tariffs on an additional $267 billion in Chinese goods.

Earlier when the tariff talk was at its incipiency, small-caps rallied on investor perception that because of their domestic focus they remain immune – or get hurt less – from trade disputes. If we are to buy into this logic, the new round of US tariffs should yet again light a fire under small-caps. Currently, they have stalled.

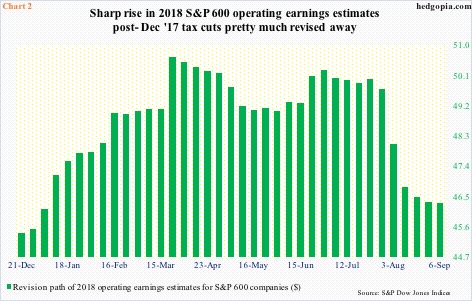

Post-US presidential election, small-caps rallied on the back of another similarly perceived tailwind. This time, the argument was that – once again because of their domestic focus – these businesses would inherently benefit more from tax cuts than their large-cap brethren. As a result, earnings estimates shot up.

The Tax Cuts and Jobs Act of 2017 was signed into law on December 22. A day prior, 2018 operating earnings estimates for S&P 600 companies were $45.41. Then they surged, peaking at $50.66 three months later. As of last Thursday, estimates were down to $46.30, meaning much of the upward revision post-tax cuts got revised away. This is not so for S&P 500 and 400 companies. For the former, 2018 estimates currently are $157.76 versus a peak of $158.24 as of July 26; for the latter, they are $103.94 versus a peak of $106.66 as of May 3.

Leave A Comment