The dollar today…

Video length: 00:01:12

Summarizing the week’s moves: Dollar dump sparks buying binge in bonds, bullion, and stocks (but sinks FANG Stocks)

Early gains – once again thanks to Gary Cohn confirming he is not resigning – topped out as Yellen’s speech was released. Once Europe closed, stocks went bid as usual, with some noise around Draghi’s speech, but the close was ugly…

Nasdaq ended red…

A big rip in Trannies sees all the major stock indices green on the week…

S&P 500 remains below its 50DMA…

NOTE that after Yellen and Draghi, stocks slid…

FANG Stocks fell on the week…(NOTE no afternoon bounce today)

Treasury yields tumbled after Yellen’s unhawkish speech, pushing all but 2Y lower on the week…

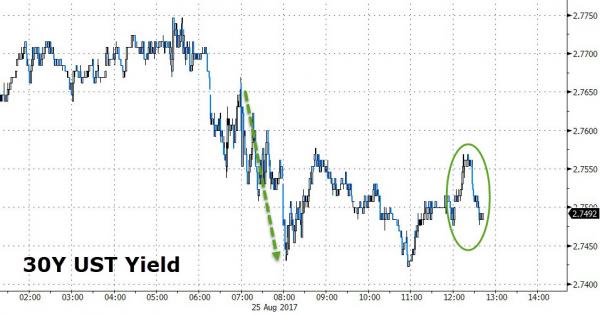

30Y Yield ended back near June 26 lows, dropping on Yellen’s speech (NOTE the pop and drop in yield as Draghi’s speech dropped)…

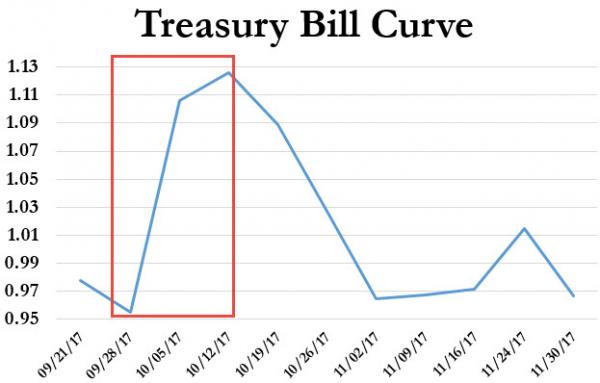

The Bill curve remains seriously inflected BUT the spread across the end of September did drop very modestly today…

The Dollar Index was the most obvious vehicle to react to J-Hole chatter today, tumbling to its lowest level since July 2015 after Yellen offered nothing ‘hawkish’…

Intraday, the moves are clear as Yellen and Draghi spoke…Biggest down day for the dollar since March 15 rate hike…

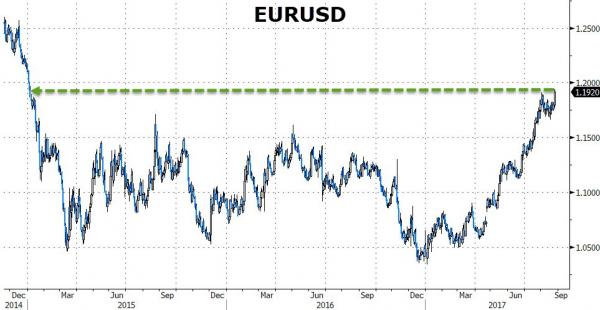

EUR was the week’s biggest gainer…

EURUSD spiking above 1.19 to the highest since Jan 2015…

Dollar’s drop helped support commmodities with copper outperforming, gold and silver both up (but crude down on Harvey hammering)…

Leave A Comment