Financial media, Fed watchers, and the punditry pay special attention to the Kansas City’s Fed’s annual conference at Jackson Hole. It is a forum that draws top speakers, innovative ideas, and a sense of the possible policy changes. I expect that a key question will be the reduction of the Fed’s $4.5 trillion balance sheet – how much, and how fast?

Because many market participants attribute the increase in asset prices to liquidity generated by the QE programs, markets are sensitive to any change. Even the contemplation of a reduction in QE caused the “taper tantrum” market reaction. Later decisions ending QE programs did not have the same effect. What about now?

I have frequently written that the punditry under-estimated the effect of a stronger economy and growing earnings, and over-estimated the QE effect. Commentary has more to do with a simple, persuasive theme than disciplined economic analysis.

A Costly Misperception

Investors pay too much attention to the Fed, and not enough to expected earnings and inflation.

Two months ago, I explained why the Fed plan to allow holdings to expire without replacing them would have a small impact. The key factor is that this is not a two-party market, but one with depth far greater than the securities offered. The problem with my explanation is that it requires a basic economic understanding of economics. It does not reach those who are proud that they never took Econ 101.

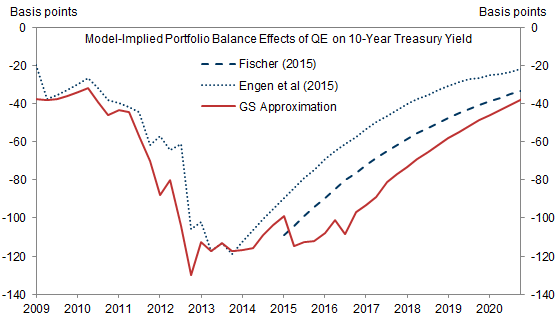

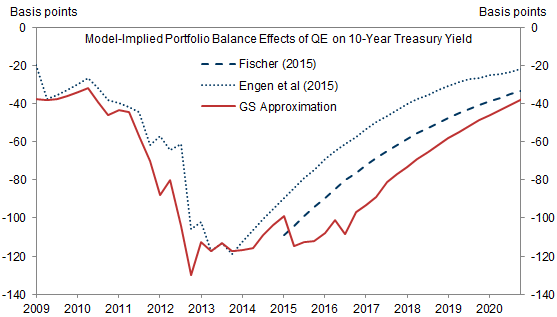

We are already seeing scary articles on the effects of the unwind. (Almost always ends in recession, based on six cases. This is an author on a mission!) This analysis, suggesting an increase in ten-year yield of 12.5 bps per year, is much closer to the truth.

Since I am trying to help investors, I seek the most persuasive presentation of truth. Instead of relying on basic economic theory, let us try a completely different approach.

A Natural Experiment

Suppose that a single owner held 60% of an asset and wanted to liquidate the position in a year. There is a right way, and a wrong way to accomplish this. It is the question faced by the Federal government when it wanted to conclude its ownership position in the stock of General Motors (GM). Here are the key events:

Leave A Comment