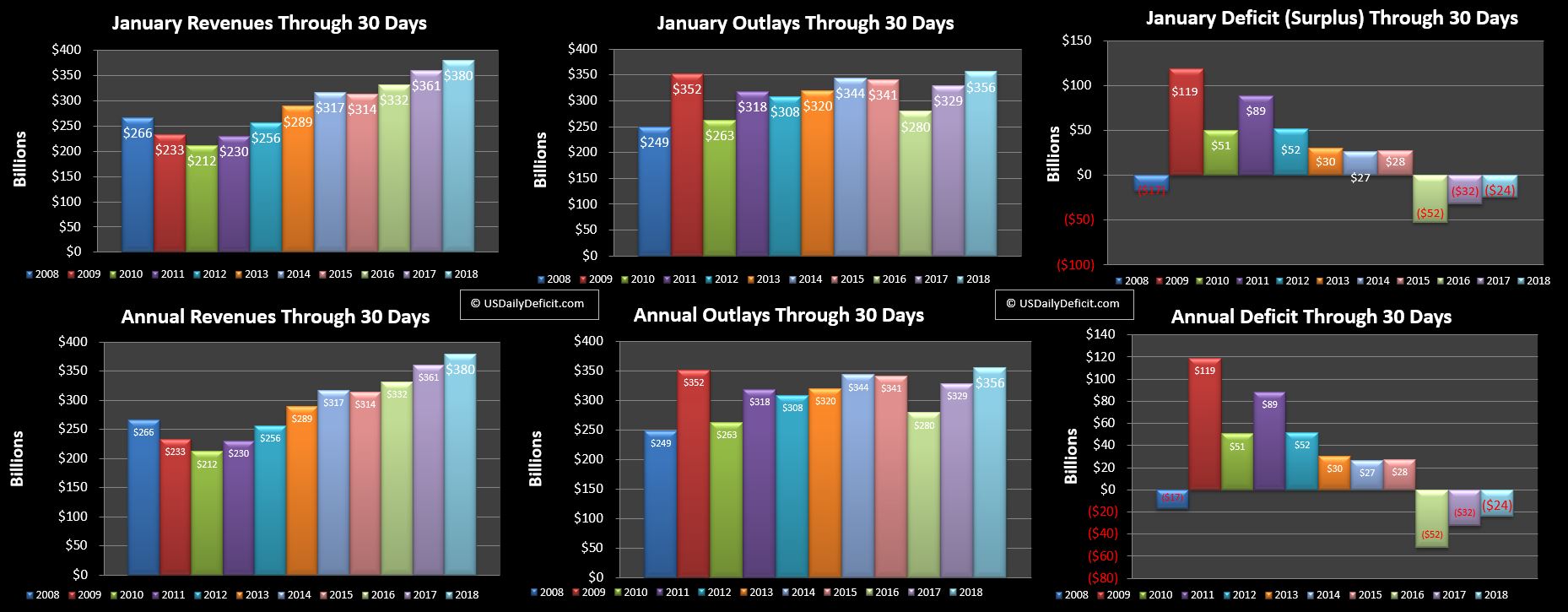

The good news is we start the year with a surplus, but that was more or less expected… January is, in general, a strong revenue month as un-withheld tax deposits start flowing in… $75B in January vs. $13B in December. Last January ran a $32B surplus and January 2018 comes in just a little lower at $24B.

Revenue

Tax cuts may have been passed for 2018 but 2017 taxes are still flowing into the coffers leading to a $19B, and 5% YOY increase… not a bad start to 2018. Don’t get too excited yet… most of that can be chalked up to an additional business day. New tax withholding tables were released and supposed to be implemented in February… I think I can see it in the February data but it will be March before we really have enough data points to be sure. From here out…just staying flat should be seen as a win, so I don’t really expect that $19B YOY lead to hold for long, though tax refund season can always throw us for a loop either way.

Outlays

Outlays increased YOY by $27B, food for an 8% bump, more than offsetting the revenue gains. As with revenue, the extra business day is part of it… there were increases pretty much across the board but the Thrift Savings plan jumps out… $3B January 2017 to $13B last month. I don’t have an inside scoop here, but basically, this is the government employees equivalent of a 401K plan. My guess is that this movement is related to when federal employees invest in US government bonds. In normal times, there are a few $B going in and out of the fund in any given month. However, whenever we hit the debt limit and enact “Extraordinary Measures” it looks to me like Federal employees/(retirees??) start pulling out money hand over fist. Now that the debt limit has been suspended again, I would expect that to calm down and settle back into the $2-3B per month range.

Outlook

While January has become a reliable surplus month, February is always the worst month of the year as tax refunds start flowing out at around $100B per month. Add to that some big interest payments and generally weak revenues and we will likely post a February deficit in the ballpark of $250B with the primary variable being tax refunds. For the full year, the recent deal to avoid a shutdown and increase the debt limit supposedly added close to $400B of spending over the next 2 years including nearly $100B of disaster aid. I don’t have a good feel for the timing but spread equally that’s about $17B a month or a 5% increase by itself, not including the baseline increases we already expect like the gradual march upwards in Social Security, Medicare, and Medicaid. I will stay tuned for details but a $1T deficit in 2018 is looking more likely by the day.

Leave A Comment