Abenomics ‘hope’ and ‘reality’ explained by Diapason Commodities’ Sean Corrigan – do you believe in miracles? After last night’s Japanese GDP print, hope is all that is left.

So, if the BOJ can just move prices up for long enough, people will start to demand higher wages while companies will gladly accede, since they will be able to count on the Bank printing enough new money for them to meet the extra expense. As such higher wages are spent, this will mean that both the employers’ sales and, miraculously, their profits will increase to the extent that they will soon be jostling to hire more of these nominally costlier workers.

Somehow or other, wages will outstrip prices (so avoiding a disastrous fall in real incomes) yet payrolls will rise alongside wages since profits will outpace the gain in the outlay on labour.

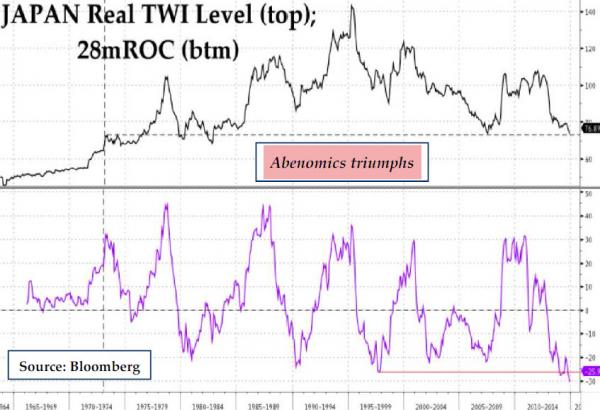

Moreover – and here we get to the crux of the issue – though all this new cash is being generated by monetizing vast, ongoing government deficits, the debt stock will rise more slowly than prices, so postponing, if not indeed averting, the nation’s long feared budgetary implosion as it is painlessly inflated away.

Oh – and there will be no first-user Cantillon inequities, no unintended consequences, no spill over to other countries, no undue enrichment or undeserved immiseration of any member of the domestic populace along the way.

Truly Kuroda-san is a mage of the highest order!

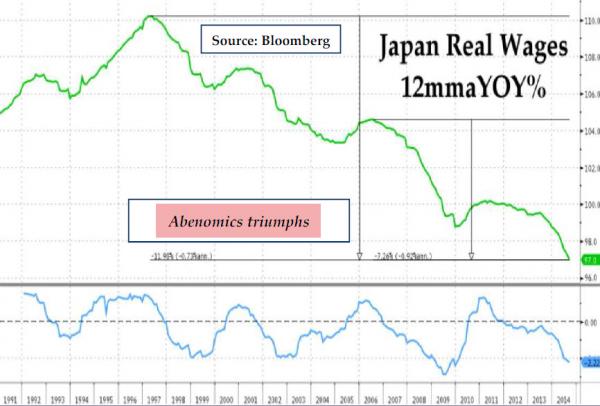

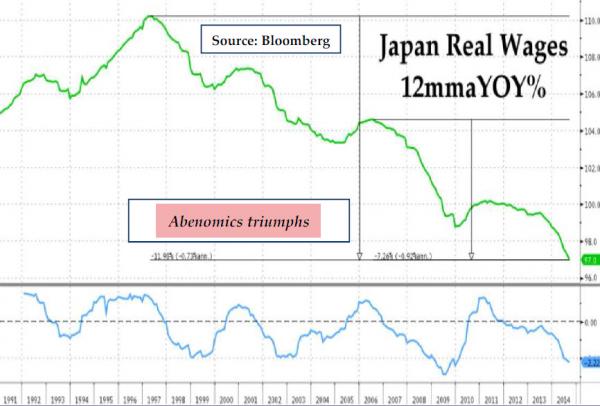

Sadly, however, the government’s own figures show that real wages have been falling ever since the start of 2012 and now lie more than 7% below the pre-Crash level and 12% beneath the mid-90s peak.

Hours worked, too, are struggling to stabilize at levels less than 1% above the Crisis lows, 4% below the previous high and fully one sixth below their Bubble best.

As for profits, well the Tokyo Shoko Research institute revealed that the rise in costs principally associated with the weaker yen had led to a 140% jump in recorded bankruptcies of SMEs, 40% of those being (unsurprisingly) in the transportation industry, and around 20% in each of manufacturing and wholesale.

Meanwhile, the Nikkei news reported that, among their bigger brethren, life was not entirely a bed of roses, either.

While overall group profits were up 10% yoy (if only in depreciated yen terms) for the 1,106 listed companies that had filed reports for the fiscal first half. However, closer inspection shows that just one of these – Softbank, luxuriating in its participation in the gangbuster Alibaba IPO – was alone responsible for more than a quarter of the Y1.34 trillion increment, while the next nine most profitable – mostly the giant export concerns, of course, accounted for another 55% of the improvement. That left a paltry Y240 billion uptick to be shared out among 1,096 others for an average gain of Y219 million or $1.9 million at current exchange rates.

Leave A Comment