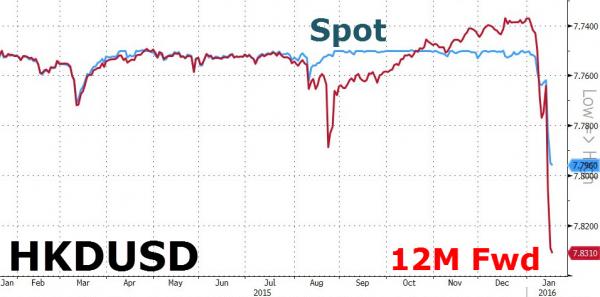

With Hong Kong Dollar spot little changed (but pressing the weaker end of its peg band) and 12-month forwards suggesting notable weakness/depegging to come, it appears that the Hong Kong interbank lending debacle is far from over. While overnight money appears stable, 1-week Yuan HIBOR is up 370bps at 11.90%, and 1-month and 3-Month HKD HIBOR just snapped higher ( to Jan 2013 highs and July 2010 highs respectively). It appears comments from Hong Kong Monetray Authority’s Norman Chan that it’s just a matter of time before outflow of funds lead to the local currency hitting the low end of the peg sparked heavy medium-term demand for liquidity. Offshore Yuan is crepping back weaker (as is crude) after an early bounce.

*YUAN 1-WEEK HIBOR RISES 370 BPS TO 11.90%

And while the levels are not as exciting the relative spike is notable in HK interbank markets.

*HONG KONG 3-MONTH HIBOR RISES TO HIGHEST SINCE JUL. 2010

*HONG KONG 1-MONTH HIBOR RISES TO HIGHEST SINCE JAN. 2013

But for now spot is stable (albeit at the weak-end of the peg band)…

After an early bounce, crude is retumbling as stress hits HKD…

Offshore Yuan is giving up more short squeeze gains…

And Japan’s Nikkei 225 closes below 17,000 for the first time since September…

Leave A Comment