Remember the original widow maker macro trade? More than a decade before short China positions filled hedge fund portfolios. Way before the long VIX trade. And before Australian and Canadian real estate was even worthy of consideration by global macro traders, there was the JGB short.

The Japanese Government Bond market was the first truly asinine Central Bank fueled bubble. Macro traders fell over themselves shorting it, hyperbolically venting about the un-sustainability of the Japanese government policy.

I won’t pretend I didn’t succumb to the romantic allure of the JGB short. It was a dark seductive mistress and as some pundits joke, you aren’t a real macro trader until you have lost money shorting JGBs.

And it’s easy to see why it was such a popular trade. In 1990 the 10-year JGB yield was 8%. By 2000 it had declined all the way down to 2%. But since then, regardless of the absurd amount of debt created by the Japanese government, the yield has only fallen.

Wild, eh? And now it’s become completely farcical with the BoJ pegging the 10-year maturity to 0%.

So far this nothing new. No big revelations here.

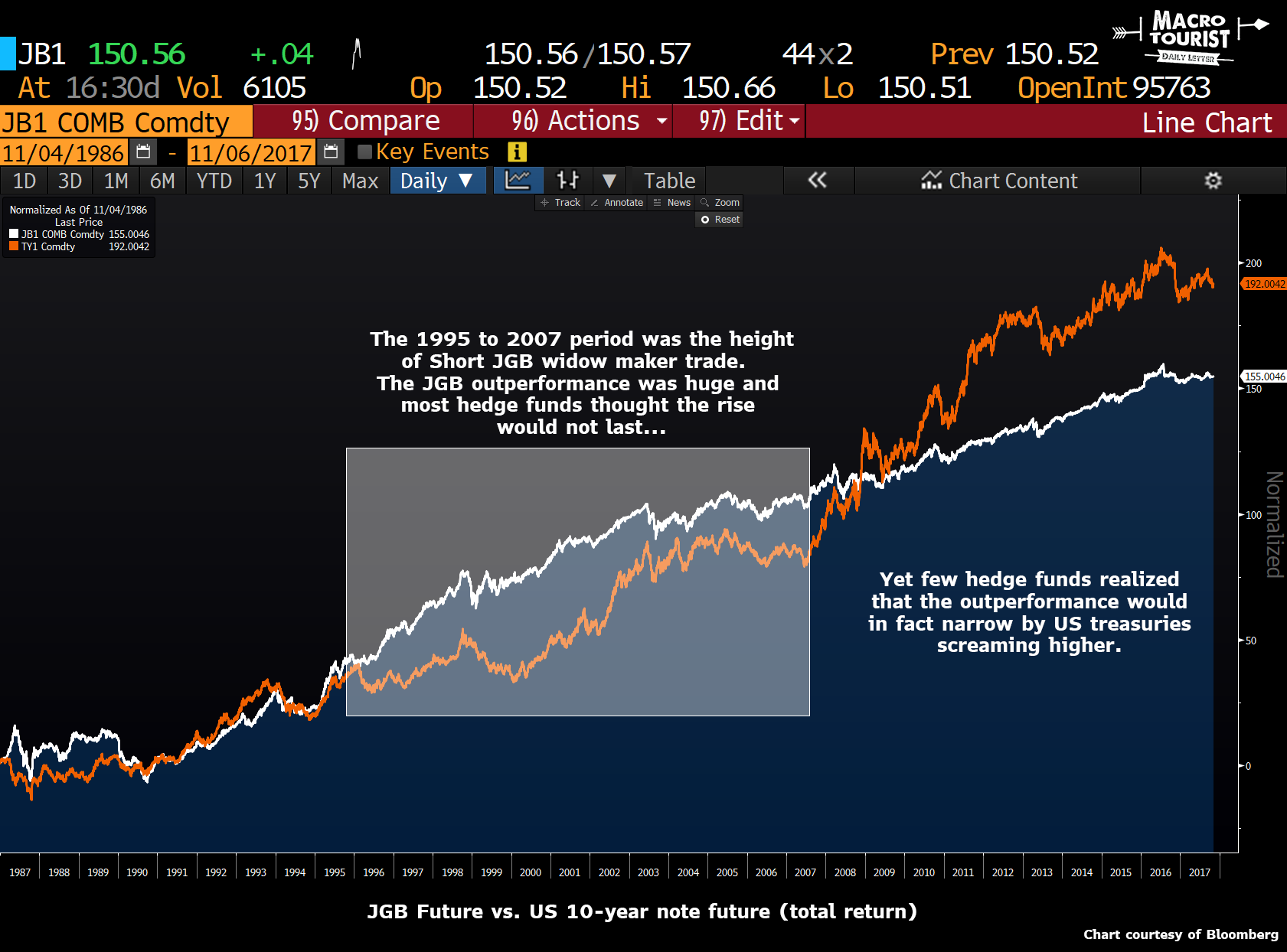

Now if asked you what has performed better – the US 10-year note or JGBs, what would you answer? I would have said the JGBs by a long shot. After all, they have gone from 8% to 0%. During the same period, the US 10-year yield went from 9% to 2.3%, so it would make sense that JGBs have outperformed.

For a long time, this analysis was spot on correct. Right until the Great Financial Crisis of 2007, the JGBs outperformed by a long shot.

Yet instead of this relative outperformance narrowing by JGBs collapsing, the opposite occurred. US treasuries screamed higher.

I must admit I was quite surprised learning how much US treasuries have beaten JGBs over the past decade. But when you look at the yield chart it becomes obvious. JGBs have been yielding next to nothing for quite some time. So the reality is that all the capital appreciation has gone. Meanwhile, the US 10-year note has been quietly clipping a coupon of at least 2%.

Leave A Comment