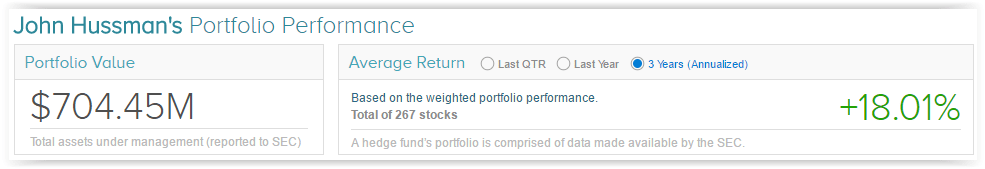

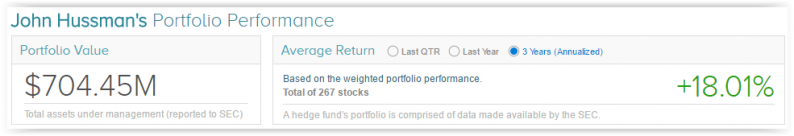

With consumer emphasis shifting to health consciousness, many companies are increasing their focus on health-related segments and products. Investors such as John Hussman have also been cashing in on this trend. John Hussman, hedge fund manager of Hussman Strategic Advisors Inc, has recently made some changes to his holdings. According to TipRanks, his current portfolio value is valued at $704.45 million with an average return of +18.01% over three years. Let’s take a look at Hussman’s fourth quarter investments in General Electric Company (NYSE: GE) and PepsiCo, Inc. (NYSE: PEP).

General Electric Company

In the last quarter, Hussman purchased 350,000 shares of General Electric. GE has a market cap of $283.46 billion, an enterprise value of $398.96 billion, a P/B ratio of 2.88, and a dividend yield of 3.21.

This new addition to his portfolio may have been a wise move according to analysts. According to TipRanks, based on 10 analysts in the last 3 months, 7 have consented to buy the stock, and in the last 3 months, the average price target for GE is $33.33 with a high estimate of $38.00.

The overall “moderate buy” consensus and recent addition to Hussman’s portfolio seems reasonable taking into account recent GE progressions in its healthcare division. Of General Electric’s $117.4 billion in total revenue last year, its healthcare business accounted for over 10%. John Flannery, CEO of GE’s healthcare division has shed some light on the subject saying, “This is a huge, essential market around the world, it’s a $7 trillion market; it’s 10% of global GDP; it’s higher than that in the U.S. obviously; it has core long-term growth drivers.”

Recent deals for General Electric include a $200 million managed-service contract in Kenya, a $100 million cancer care research center in India, and plans to further the division in China with a $5 billion healthcare business. GE expects to grow its revenue in emerging markets to $6 billion in 2020 from about $4 billion last year due to these changes.

Leave A Comment