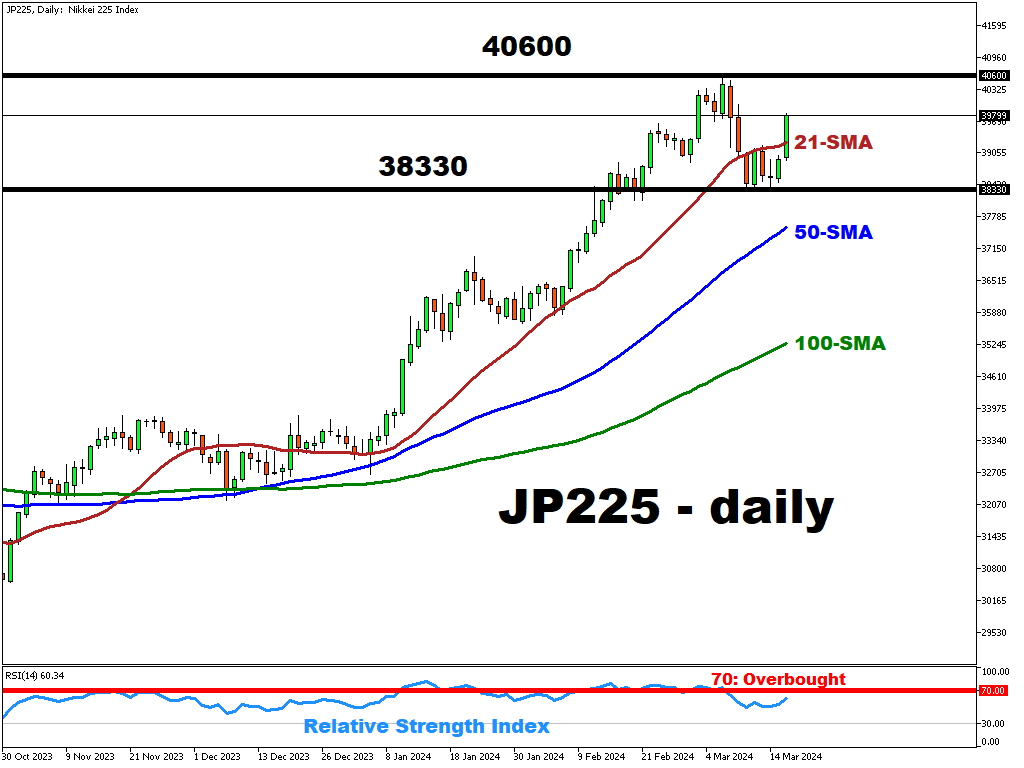

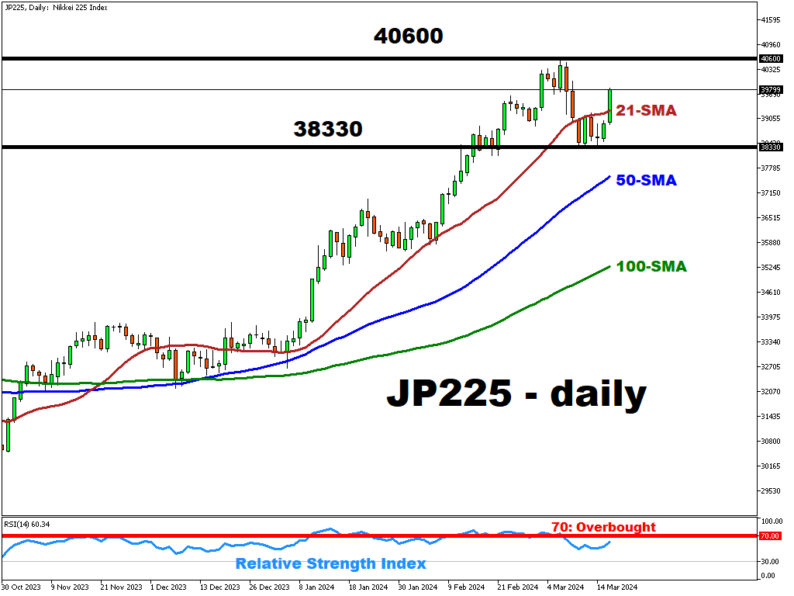

Japan’s benchmark stock index has eased away from its record high, having flirted with the 40,600 level on March 6th.However, JP225 has since discovered support around the 38,330 region – a key support area over the past month, as this stock index pulls away from “overbought” conditions.

For a longer-term perspective, Wall Street predicts that JP225 will eventually touch the 41,000 figure, which implies about 6% in potential gains from current levels.

However, key events this week are due to have a major say on just how quickly JP225 can be restored above the 4k mark.

Events Watchlist:

Tuesday, March 19th: Bank of Japan (BoJ) rate decision

In a decision that’s still too close to call, markets are leaning slightly towards a hike (57% chance) by the BoJ, especially after Japan’s largest workers union announced a bumper pay raise last Friday.Japan’s first rate hike since 2007, if it materialises, may boost the Japanese Yen while likely triggering knee-jerk declines for JP225.

Wednesday, March 20th: Federal Reserve (Fed) rate decision

The Fed is widely expected to leave US rates unchanged. However, its rates forecasts, via the infamous “dot plot”, should hold greater sway over markets.If the FOMC can stick to its prior forecast of 75 basis points in rate cuts for 2024, that may send a risk-on signal across global equities, and potentially boost JP225 as well.

Friday, March 22nd: Japan February national consumer price index (CPI)

Economists predict that the headline national CPI, which measures inflation, would come in at 2.9% year-on-year, exceeding January’s 2.2% number.However, core CPI is set to ease lower from January’s 3.5% to 3.3% y/y.Still, higher-than-expected inflation last month would amplify the 5.28% wage hike recently secured by Japan’s largest labour union federation – their largest in over 30 years.Further evidence of a “virtuous wage cycle” may invite a more hawkish BoJ, which should translate into a Yen rebound, while perhaps keeping JP225 below 4k.

Here’s a comprehensive list of other key economic data and events due this week:Monday, March 18

Tuesday, March 19

Wednesday, March 20

Thursday, March 21

Friday, March 22

More By This Author:Gold Holds Around Record High Ethereum Consolidates Around $4k After Upgrade BRN Edges Higher Towards It’s 2024 High

Leave A Comment