Ever get the feeling that the market has become frustratingly fast in responding to new information, with violent swings in either direction coming ever faster even if ultimately the “BTFD” mentality always seems to prevail? Well, it’s a fact.

As JPM reports in a new analysis, citing quantitative and qualitative metrics, markets have become more macro driven and react faster to the new information. A qualitative example below shows the reaction time for recent major events (August ’15 selloff, Brexit, US Election, Italy Referendum) that has compressed from weeks to hours (Figure below).

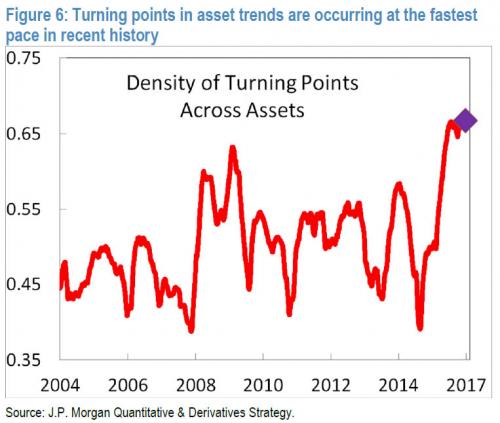

In empirial terms, this means that quantitatively, we are noticing a higher density of market turning points. The next figure shows the average variability of asset trends (averaged across major asset classes) that show turning points occurring at the fastest pace in recent history (~30 years).

Given the engagement of central banks with markets and geopolitical developments, it should not be a surprise that markets are more macro driven. Furthermore, thanks to the ubiqutous presence of collocated HFTs, which respond to to headlines in microseconds, not to mention that information is created and consumed at a much faster pace than e.g. a decade ago (think of twitter, smartphones, etc.), the market is generally much “faster.”

As JPM’s Marko Kolanovic also points out, “an emerging class of fully automated quant strategies is also likely speeding up the market reaction – these strategies process and trade on new information (e.g. feeds from tweets, press releases, etc.) in real time. Finally, we now live in a world in which everyone is a momentum chasers. As a result, the increased popularity of trend following strategies is also likely to contribute to shorter and faster trends, as strategies react quicker and lead to potential over/undershooting of fundamentally justified levels.”

What are the implications of this fast-moving market? Some further thoughts from JPM:

Leave A Comment