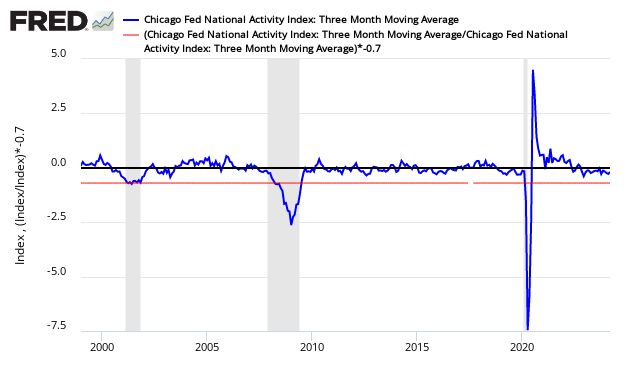

The economy’s rate of growth marginally declined based on the Chicago Fed National Activity Index (CFNAI) 3 month moving (3MA) average – and economic growth is now insignificantly below the historical trend rate of growth.

Analyst Opinion of the CFNAI This Month

The single month index which is not used for economic forecasting which unfortunately is what the CFNAI headlines. Economic predictions are based on the 3 month moving average. The single month index historically is very noisy and the 3 month moving average would be the way to view this index in any event.

In the table in our analysis below, see the three month rolling average for the last 6 months – it had been staying within a very tight range around the trend rate of growth of zero.

The three month moving average of the Chicago Fed National Activity Index (CFNAI) declined from +0.09 (originally reported as +0.06 last month) to -0.05.

PLEASE NOTE:

A value of zero for the index would indicate that the national economy is expanding at its historical trend rate of growth, and that a level below -0.7 would be indicating a recession was likely underway. Econintersect uses the three month trend because the index is very noisy (volatile).

CFNAI Three Month Moving Average (blue line) with Historical Recession Line (red line)

As the 3 month index is the trend line, the trend is mixed or flat. As stated: this index only begins to show what is happening in the economy after many months of revision following the index’s first release.

CFNAI Three Month Moving Average Showing Month-over-Month Change

The CFNAI is a weighted average of 85 indicators drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

Leave A Comment