This post is a review of the Philadelphia Fed’s Leading Index and all major leading indicators – and their trends are generally slowing.

Analyst Opinion of the Leading Indicator Forecasts

Most of the leading indicators are based on factors which are known to have significant backward revisions – and one cannot take any of their trends to the bank. The only indicators with minimal backward revision are ECRI, RecessionAlert’s WLEI, and the Chemical Activity Barometer. Unfortunately, the Chemical Activity Barometer is targeted to the industrial sector of the economy – and at best seems to be a coincident indicator, not a leading indicator. Note that both ECRI and RecessionAlert are forecasting marginally negative growth over the next six months.

The leading indicators are to a large extent monetary based. Econintersect does not use any portion of the leading indicators in its economic index. Most leading indices in this post look ahead six months – and are all subject to backward revision.

At this point, Econintersect continues to see NO particular dynamic at this time which will deliver noticeably better growth in the foreseeable future – and the majority of the indicators are forecasting a near average rate of growth which has been seen since the end of the Great Recession.

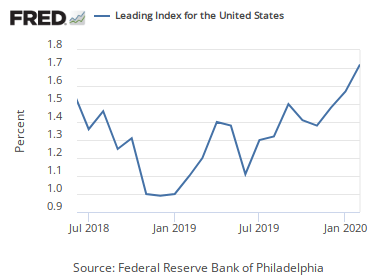

Philly Fed Leading Index

The Philly Fed Leading Index for the United States is continuously recalculated. Note that this index is not accurate in real time as it is subject to backward revision, Per the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the leading indexes for the 50 states for July 2018. The indexes are a six-month forecast of the state coincident indexes (also released by the Bank). Forty-nine state coincident indexes are projected to increase over the next six months, and one is expected to decrease. For comparison purposes, the Philadelphia Fed has also developed a similar leading index for its U.S. coincident index, which is projected to grow 1.2 percent over the next six months.

Leave A Comment