I last wrote about earnings from KB Home (KBH) well over a year ago. While I kept tabs on the stock through my Housing Market Reviews, I never set up specific decision points for getting back into the stock. I finally created a decision point on October 12th when I made a hedged play of call and put options. Given my general bullishness on the housing market, I normally buy call options on home builders. However, the current run-up in KBH is so persistent, so strong, and so steep that technical prudence dictated taking seriously the potential for a near-term pullback.

KB Home has rocketed upward through its upper-Bollinger Band channel.

Source: FreeStockCharts.com

As the chart above shows, the reaction to KBH’s last earnings report was swift and decisive. KBH gapped up and broke out above its 50-day moving average (DMA). The next day, KBH set a new 9-year high and a vigorous repricing began. The stock is now at a 9 1/2 year high. Two main themes came from KBH’s earnings: 1) the unfolding payoff from the company’s on-going efforts to improve operations and profitability, and 2) the overall impact from the hurricanes in Texas and Florida will be minimal.

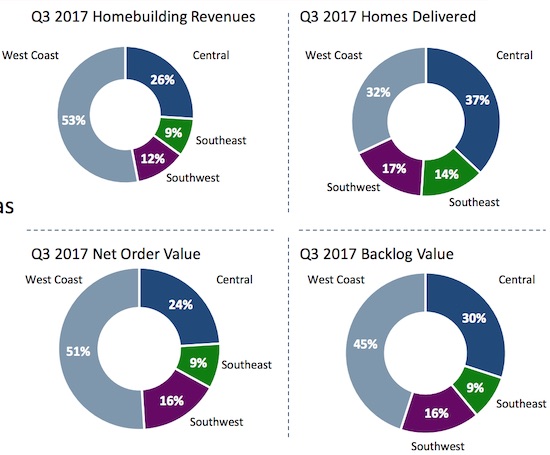

My main caution on KBH is its increasing reliance on the strong results and pricing power in the West, especially the San Francisco Bay Area. For example, in Q3, the West Coast represented 32% of homes delivered but a very dominant 53% of homebuilding revenues.

The West Coast region dominates the monetary value of business for KB Home.

Source: KBH investor presentation for 2017 Q3

This quote from the transcript of the earnings conference call demonstrates the heavier reliance on California:

“We grew housing revenues to over $1.1 billion as we continue to benefit from our growing scale in California and a larger percentage of our deliveries coming from our highest ASP region. While our overall average selling price in the quarter was up 12% to roughly $411,000, we continue to offer product in locations that appeal to first-time buyers who accounted for 53% of our delivery…

Housing revenues were up in three of our four homebuilding regions with year-over-year increases ranging from 9% in the central region to 47% in the West Coast region.”

Leave A Comment