This post has to do with something which may seem like an oxymoron: integrity in financial prognostications. What inspired me to address this topic? Oh, that’s easy:

As you can see, back on February 22nd, Dennis “Commodity King” Gartman went on CNBC to declare that, at long last, for the first time in about five years, he was bullish on crude oil.

Savvy traders jumped on this and, knowing Gartman’s tendency to generate reputational pratfalls, shorted the bejesus out of crude oil and were richly rewarded for it. But this is not about Gartman’s well-documented tendency to, shall we say, not have a perfect record. It has to do with this “five years” nonsense.

I’m not sure if Dennis thinks (1) we’re all really stupid or (2) we don’t have access to this here newfangled “Internet” thing, but it would only take a kindergarden student about 7 seconds to completely refute the aforementioned assertion. I offer Exhibit A:

So as you can see, in October 2015, Gartman declared himself the “most bullish I’ve ever been on crude”. My arithmetic skills are strong enough to know that February 2017 minus five years is long, long before October 2015.

(I would feel remiss if I didn’t take the opportunity to also point out that October 2015 preceded one of the most calamitous collapses in the history of crude oil, so once again, the contra-signal was money in the bank. Anyway, back to our regularly-scheduled program……….)

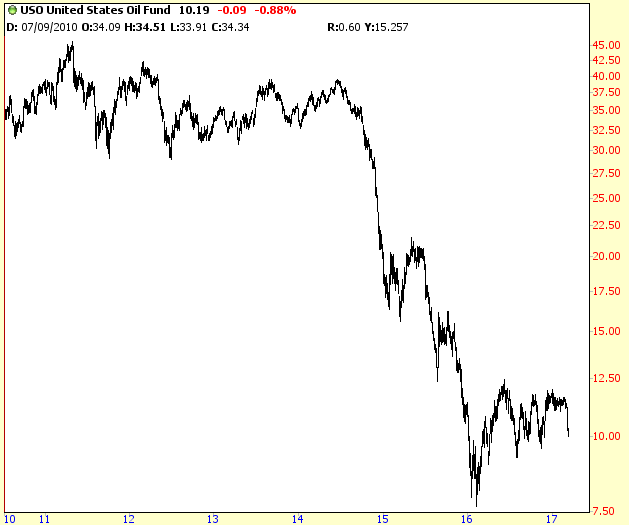

Now I can understand why someone would want you to think they’d been bearish for five solid years. After all, the past five years of crude oil looked like this:

So let’s just pretend that some person had indeed been persistently bearish on crude oil for this stretch of time, and then, just recently, he declared himself bullish. I’d sit up and take notice. After all, if someone is correct for five solid years, and then he has a different opinion, that’s worthy of attention.

Leave A Comment