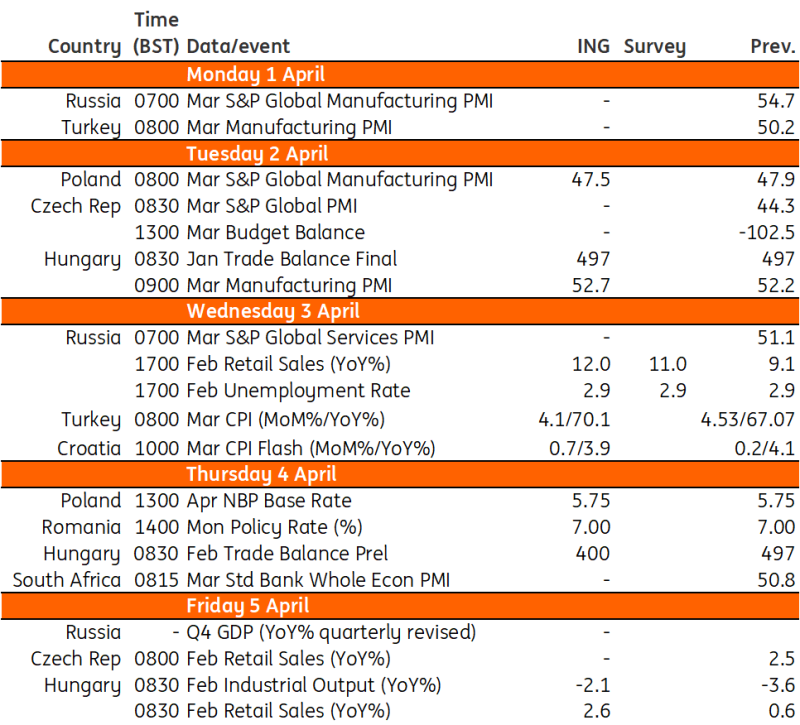

Next week is set to be a busy one in the EMEA region. In Poland, the MPC is expected to keep NBP rates unchanged in April. Over in Hungary, we see the trade balance remaining in a surplus and expect to see a significant improvement in retail sales for February. Meanwhile, annual inflation in Turkey is forecast to come in at 70.1% YoY Poland: NBP expected to keep rates unchanged in AprilPoland’s MPC is broadly expected to keep the National Bank of Poland’s rates unchanged in April. CPI inflation is likely hit a local low below the central bank target of 2.5% (+/- one percentage point) in March. This isn’t expected to be sustainable, however, as headline inflation is projected to start mounting in the following months as a result of retail energy price normalisation with prices of electricity in the first half of this year remaining frozen at 2022 levels.At the same time, core inflation remains elevated and momentum is still high. Given the uncertainty regarding the inflationary outlook, the MPC is likely to stick to its cautious approach and may refrain from monetary easing this year. The NBP governor’s press conference on Friday may be dominated by the topic of the State Tribunal for politically-driven policymaking by Adam Glapi?ski. The formal motion was put forward to the parliamentary commission in late March. Still, we expect Glapi?ski to continue stressing upside risks to inflation as the main rationale behind keeping rates at relatively high level. Hungary: Significant improvement in retails sales in FebruaryNext week will be a busy one in Hungary. On the external balance side, the Hungarian Central Statistical Office will release not only the final trade balance figure for January, but also the preliminary print for February. We expect the trade balance to remain in surplus, but with some narrowing. The main reason for such a move is that we see lower import needs (especially for energy), but also weaker export activity, as reflected in the latest manufacturing surveys and data. Speaking of which, we expect industrial production to be roughly flat on a monthly basis in February, as key sectors (automobiles and electrical equipment) suffer and global manufacturing still digests the inventory overhang. While the industrial sector won’t be strong, we see a significant improvement in retail sales in February, mainly due to rising demand as consumer confidence recovers. Turkey: Annual inflation to be at 70.1%We expect Turkey’s annual figure to be at 70.1% in March (with a 4.1% month-on-month reading) vs 67.1% a month ago. Deteriorating expectations on the back of inflation in the previous two months and an acceleration in the exchange rate in March were likely to be a key reason for another significant increase in prices last month, in our view. Going forward, the question remains as to whether or not the Central Bank of Turkey’s sharp response of an unexpected and significant rate hike, a large set of macro-prudential measures and liquidity tightening are enough to return the inflation path to the CBT’s forecast range, and this will be closely followed by the market. Key events in EMEA next week

Next week is set to be a busy one in the EMEA region. In Poland, the MPC is expected to keep NBP rates unchanged in April. Over in Hungary, we see the trade balance remaining in a surplus and expect to see a significant improvement in retail sales for February. Meanwhile, annual inflation in Turkey is forecast to come in at 70.1% YoY Poland: NBP expected to keep rates unchanged in AprilPoland’s MPC is broadly expected to keep the National Bank of Poland’s rates unchanged in April. CPI inflation is likely hit a local low below the central bank target of 2.5% (+/- one percentage point) in March. This isn’t expected to be sustainable, however, as headline inflation is projected to start mounting in the following months as a result of retail energy price normalisation with prices of electricity in the first half of this year remaining frozen at 2022 levels.At the same time, core inflation remains elevated and momentum is still high. Given the uncertainty regarding the inflationary outlook, the MPC is likely to stick to its cautious approach and may refrain from monetary easing this year. The NBP governor’s press conference on Friday may be dominated by the topic of the State Tribunal for politically-driven policymaking by Adam Glapi?ski. The formal motion was put forward to the parliamentary commission in late March. Still, we expect Glapi?ski to continue stressing upside risks to inflation as the main rationale behind keeping rates at relatively high level. Hungary: Significant improvement in retails sales in FebruaryNext week will be a busy one in Hungary. On the external balance side, the Hungarian Central Statistical Office will release not only the final trade balance figure for January, but also the preliminary print for February. We expect the trade balance to remain in surplus, but with some narrowing. The main reason for such a move is that we see lower import needs (especially for energy), but also weaker export activity, as reflected in the latest manufacturing surveys and data. Speaking of which, we expect industrial production to be roughly flat on a monthly basis in February, as key sectors (automobiles and electrical equipment) suffer and global manufacturing still digests the inventory overhang. While the industrial sector won’t be strong, we see a significant improvement in retail sales in February, mainly due to rising demand as consumer confidence recovers. Turkey: Annual inflation to be at 70.1%We expect Turkey’s annual figure to be at 70.1% in March (with a 4.1% month-on-month reading) vs 67.1% a month ago. Deteriorating expectations on the back of inflation in the previous two months and an acceleration in the exchange rate in March were likely to be a key reason for another significant increase in prices last month, in our view. Going forward, the question remains as to whether or not the Central Bank of Turkey’s sharp response of an unexpected and significant rate hike, a large set of macro-prudential measures and liquidity tightening are enough to return the inflation path to the CBT’s forecast range, and this will be closely followed by the market. Key events in EMEA next week  More By This Author:Poland’s CPI Below Central Bank Target As Food Price War Rages On

More By This Author:Poland’s CPI Below Central Bank Target As Food Price War Rages On

Disinflation Accelerates In France

Key Events In Developed Markets For The Week Of April 1

Leave A Comment