Next week will be relatively quiet in the EMEA region. Following strong global deflationary trends, a high reference base and a price war between large retailers, we expect Poland’s CPI to fall to 3.3% YoY in February. In the Czech Republic, we see a further fall in CPI inflation to 2.3% – well below the central bank’s 2.8% target.

Poland: We expect February CPI to be 3.3% YoY

CPI (Feb): 3.3% YoYWe forecast that strong global deflationary trends, a high reference base and a price war between large retailers pushed CPI inflation to 3.3% year-on-year in February from 3.9% YoY reported in January. Monthly price growth last month was much lower than in February 2023, which translated into further decline in annual consumer inflation. A substantial increase in gasoline prices compared to January was accompanied by a slight decline in house energy. This was a result of cheaper coal and moderate growth in food prices amid the price war.At the same time, core inflation excluding food and energy declined to 5.3% YoY from 6.4% YoY in January. The StatOffice will also update CPI basket weights, which may bring a slight revision to January’s CPI estimate. Headline inflation is projected to reach a local low in March, around the National Bank of Poland’s target of 2.5%. It’s then expected to rise moderately as VAT on food is re-introduced in April and the energy shield is amended in the second half of this year, leading to some increases in electricity prices.

Czech Republic: Inflation inches closer to CNB’s target

We expect inflation to slow significantly from 1.5% to 0.4% MoM after the January repricing, but we think it’s likely to still contain signs of that repricing. This should translate into a further drop in inflation from 2.3% to 2.1% YoY, well below the Czech National Bank’s forecast of 2.8%, maintaining the same deviation as in January. On the downside, we see a slight decline in food and clothing prices. On the contrary, on the upside, we expect higher fuel prices but also a slight increase in housing prices. According to our estimates, inflation also fell from 2.9% to 2.7% YoY, well below the CNB’s 3.5% forecast.

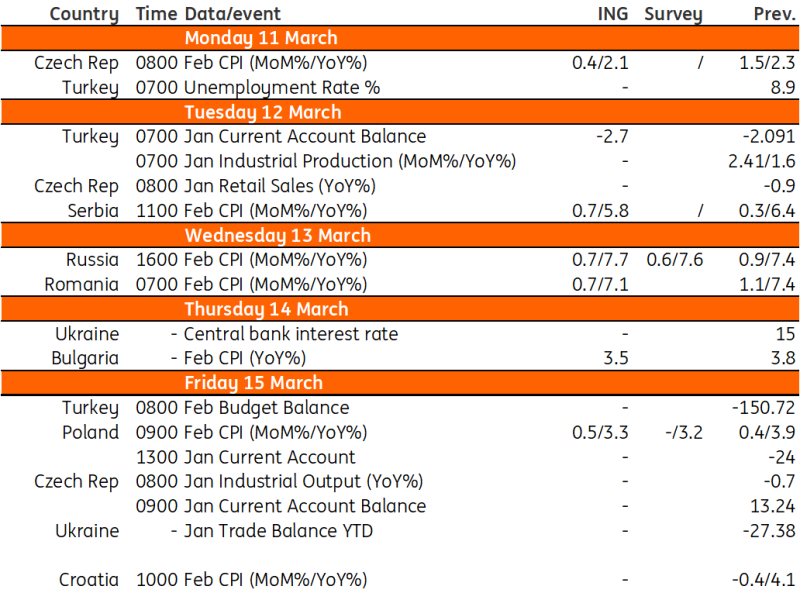

Key events in EMEA next week

Refinitiv, INGMore By This Author:Monitoring Turkey: Balanced Economy Still Some Way Off US Jobs Report Hints At A Gradual Cooling Despite A Strong Headline Key Events In Developed Markets For The Week Of March 11

Refinitiv, INGMore By This Author:Monitoring Turkey: Balanced Economy Still Some Way Off US Jobs Report Hints At A Gradual Cooling Despite A Strong Headline Key Events In Developed Markets For The Week Of March 11

Leave A Comment