After a tumultuous week in the world of politics, with non-stop Trump drama in the US, a disastrous week for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp (see full Goldman preview here), while the BOJ, BOE and SNB all remain on hold.

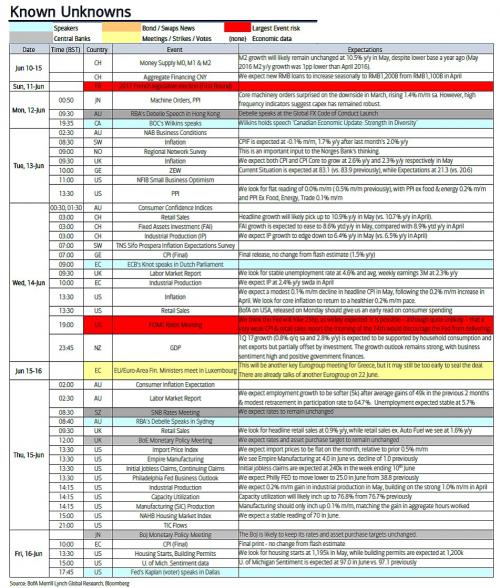

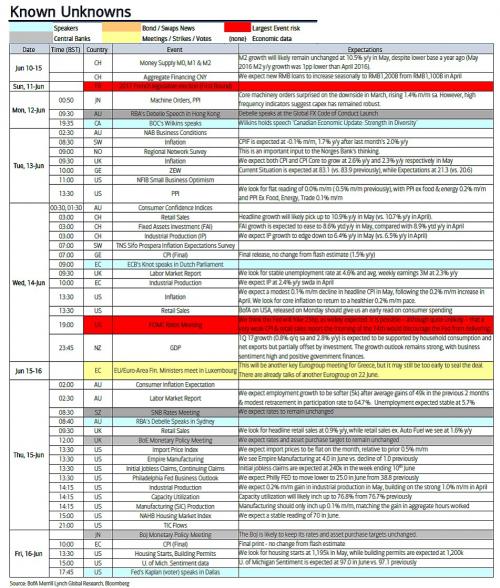

Courtesy of BofA, here is the breakdown of key events:

After the eventful UK election, and less than eventful ECB meeting, the week ahead is a busy one, opening with the first round of the French parliamentary elections and with a plethora of data releases and central bank decisions to keep markets occupied. Another important Eurogroup meeting for Greece rounds out a full schedule.

The FOMC meeting will be the main event of the week, where the Fed will deliver a 25 bps rate hike, in line with market expectations. While very weak retail sales or CPI could dissuade the Fed, this remains a very unlikely scenario absent a collapse in Wednesday’s CPI print. BofA expects lower inflation and growth forecasts, while the dots will show 3 hikes in 2018 and 3.25 hikes in 2019. The press conference will likely be focused on balance sheet normalization and implementation timing.

The BoJ is likely to keep its rates and asset purchase targets unchanged, with focus still on potential changes to the “around JPY80tn” guideline for the pace of JGB purchases, which will stay for now. The BoJ will be inclined to send a dovish message, differentiating itself from the Fed and ECB.

In the UK, although data since the last meeting justifies a more dovish tone, there will also most likely be no change in policy from the BoE.

BofA again expects no change in policy from the SNB. They will likely remain consistent with previous statements, emphasizing persistent overvaluation of the CHF and reinforcing their readiness to intervene in FX or take further action if necessary.

There will be monetary policy meetings in Russia, Turkey, Indonesia and Chile. We forecast Russia CBR to cut the monetary policy rate by another 50bp.

A busy week ahead in the US, with retail sales, CPI, industrial & manufacturing production, housing data and Philly FED, all in addition of the key FOMC meeting. In the Eurozone, we have final inflation prints and industrial production, as well as the first round of the French legislative election is held on Sunday. In the UK, another important week ahead after the eventful General election. We have a BoE meeting, labor market report, CPI and retail sales on the schedule. In Japan and Switzerland the main event will be the BoJ and SNB decisions respectively. In Australia, focus centers on the labor market report, with business and consumer sentiment also released. In New Zealand, 1Q GDP is coming up.

Below is the breakdown of key events by day, courtesy of DB’s Jim Reid:

early focus is the May CPI report and retail sales data for May, followed later on by the outcome of the FOMC meeting.

Leave A Comment