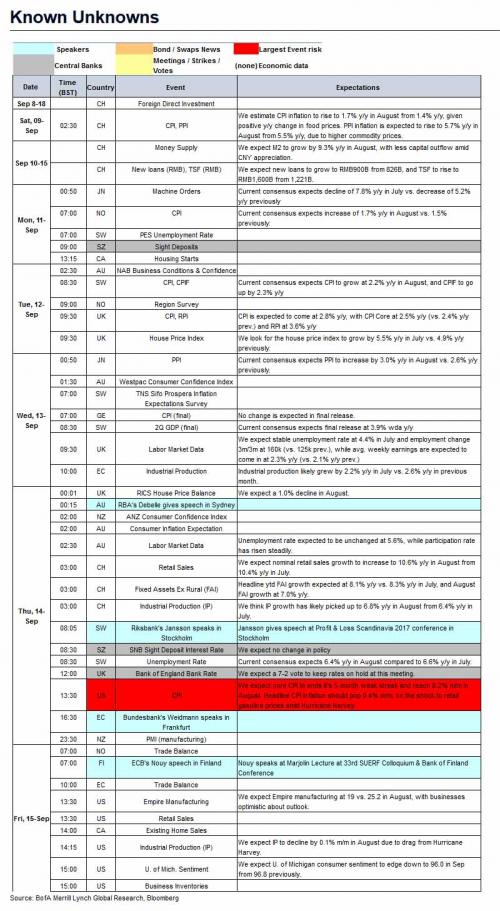

In a somewhat quieter week for economic news, this week’s focus is on BoE and SNB policy meetings as well as on inflation releases in US, UK, China and others. Other releases of note include retail sales in the US, UK and China along with industrial production in US, Eurozone & China.

Key events:

Tuesday: UK Inflation Data

Wednesday: UK Labour Market Report (Jul/Aug)

Thursday: Bank Of England Decision, SNB Decision, US CPI (Aug), Australian Labour Report (Aug), UK Retail Sales (Aug)

As BofA previews the week’s main events, watch for BoE and SNB meetings:

After a surprise hike from the BoC last week, we turn the attention to the BoE and SNB. At the BoE meeting on Thursday, consensus expects a 7-2 vote to leave rates unchanged. This said, given the GBP depreciation since the August meeting, the rhetoric will be less dovish and with the potential to challenge current rate hike pricing upwards. Again, the relevance of such rhetoric is purely confined to market communication: no rate hike is expected before 2019.

Also the SNB holds the monetary policy meeting on Thursday: our economists do not expect a policy change. The economic rationale for very accommodative policy remains. In fact, GDP growth has been disappointing and nominal wage dynamics remain subdued while the ECB has not meaningfully changed its policy stance, yet.

…and inflation releases in the US, UK and others

Economists expect US inflation to increase to 0.2% m/m, while headline inflation is set to rise to 0.4%, given Hurricane Harvey’s impact on gasoline prices. UK inflation is expected to come in somewhat hot at 0.5% m/m.

A detailed breakdown of key events by day, courtesy of Deutsche Bank:

Monday is fairly quiet data wise with only Italy’s industrial production for July and France’s business industry sentiment index due.

On Tuesday, in the UK, we’ve got August CPI, PPI and RPI data. Across Europe, France’s 2Q total payrolls and Italy’s 2Q unemployment rate are also due. Over in the US, there is the NFIB small business confidence reading and July JOLTS job openings.

Turning to Wednesday, Japan’s August PPI will be out in the early morning. The Eurozone’s July IP and 2Q employment stats are also due. Elsewhere, there is the final reading on August inflation for Germany. Over in the UK, the ILO unemployment rate for July, claimant count rate and jobless claims change stats are due. In the US, PPI for August, monthly budget statement and MBA mortgage applications stats are also due.

For Thursday, there will be numerous data out in early morning, including China’s August IP, fixed asset investment and retail sales data along with Japan’s final reading for July IP. In the UK, the RICS housing market survey will be out in the early morning. Then there is the BOE rate decision, asset purchase target as well as the retail sales data for August. In France and Italy, the final readings on the August inflation are also due. Over in the US, the August CPI report along with initial jobless claims data are due.

Finally on Friday, the Eurozone’s trade balance stats for July are due. Then the US will release numerous data including IP for August, empire manufacturing survey, August retail sales, business inventories as well as the University of Michigan’s consumer sentiment index.

Leave A Comment