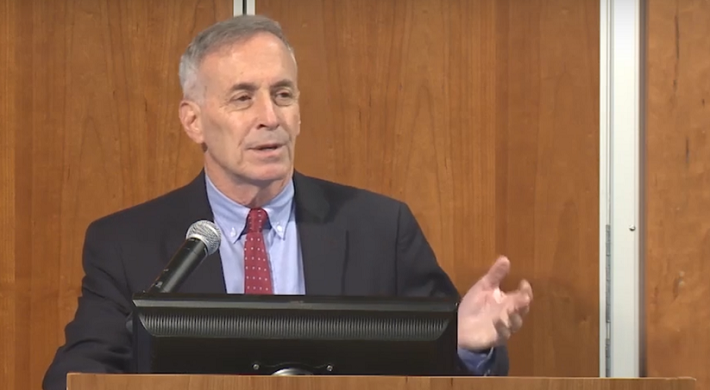

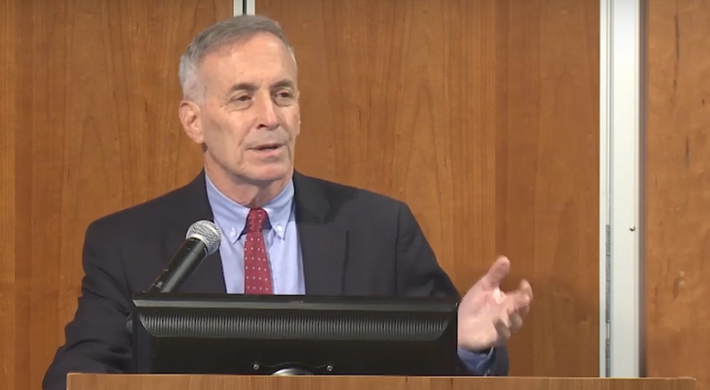

America’s 2017 fiscal gap will come in near $6 trillion, nine times higher than the $666 billion deficit announced by the US Department of the Treasury week, says Laurence Kotlikoff, an economics professor at Boston University.

“Our country is broke,” says Kotlikoff, who estimates total US government debts at more than $200 trillion, when unfunded liabilities are included. “We are in worse shape than Russia, China or any developed nation.”

Worse, says Kotlikoff, who has testified before Congress, government officials are well-aware that many of America’s debts and accruing liabilities are being written off the books.

However, for the most part, they are keeping their mouths shut.

A two-tier reporting system

The upshot is a de facto “two-tier” financial reporting system, in which politicians and insiders have access to key data buried in footnotes about unfunded liabilities, which indicate that there are huge problems in the economy.

The public, on the other hand, in slews of Presidential and Congressional Speeches and publications, is led to believe that while things are tough, overall everything is OK.

According to Kotlikoff, a long-time activist for fiscal rectitude, the problem stems in large part from the fact that the US government has been spending almost all of Americans’ approximately $795 billion in social security payroll taxes to pay current bills, rather than investing them to fund retirees’ benefits.

The upshot is that on a net basis, the US government has no money to pay all the benefits that have been promised. Politicians know that defaults will occur, they just haven’t figured out how to finesse this.

Fiscal gap accounting: telling Americans how much government has borrowed

Kotlikoff, unlike most, has a solution. He believes that the US government should adopt what he calls “fiscal gap accounting”, which involves putting all future receipts and expenditures on its books.

Leave A Comment